Welcome to my “market diary” where I concentrate the most on ES_F futures.

Everything posted here and/or in the chat room that is a free addition to the newsletter for subscribers is for educational purposes ONLY. This is NOT financial advice, and the author is NOT a Financial Licenses Professional.

I send daily posts with my “algo chart” and market TA plus weekly posts with some additional probabilities, etc. for ES_F and many other instruments.

The majority of market intraday thoughts are shared / commented on in the Discord chatroom (below is link to "Discord post” with information on how to join if interested).

Chart legend and small info about charts, levels, setups, etc what might be seen in the posts/chat:

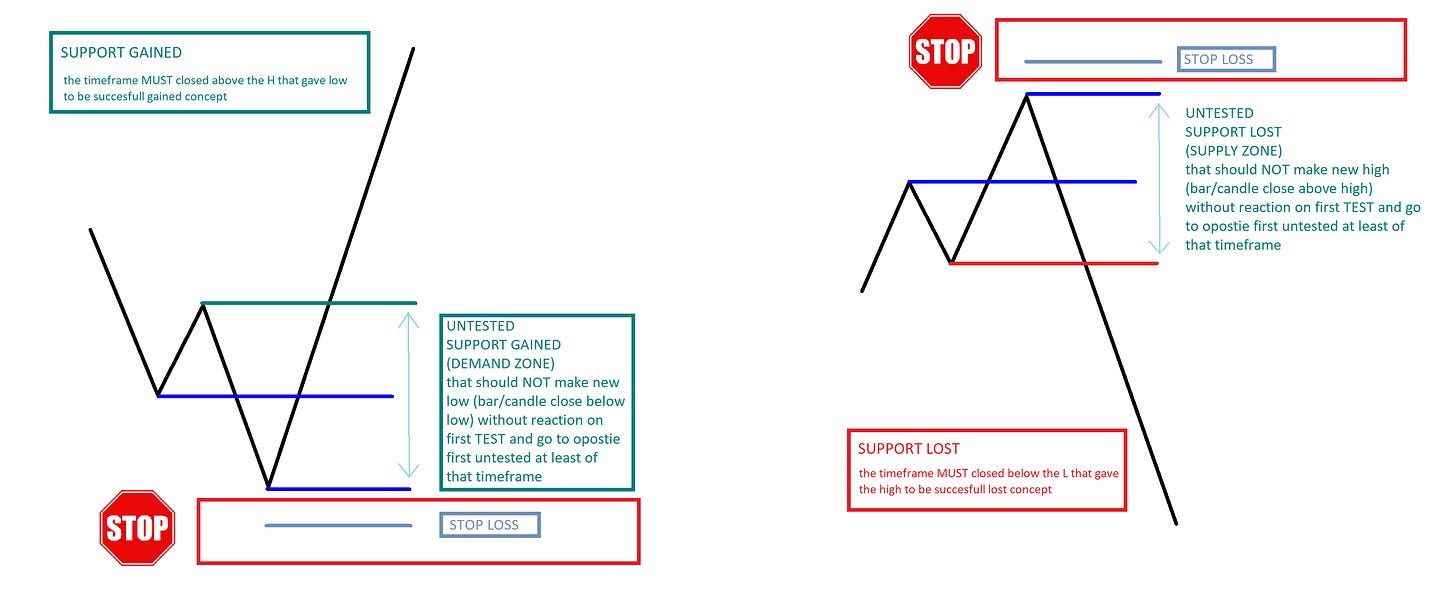

About 90% of what I do is based on the core idea, which I tried my best to describe in the methodology-pinned article and review in the videos that are all uploaded to the video library in chat. It is all about supply and demand !

Again, more about all of that is in the methodology post. In my opinion, the "best A+ setup" is based on the back test, and that is my favorite setup overall.

Charts with blues and purples lines (posted once a week or anytime in chat) are formulas generated “algo levels” for:

🟦 Blue(s) for week probabilities.

🟪 Purple(s) for month probabilities.

Solid lines represent “line in sand” for week or month base on color

Charts for every day are formulas generated “algo zones” for each day separate:

🟥 Red(s) are probabilities resistance R1,R2 and “Extreme”.

🟨 Yellow(s) are “chop” zone and when I see (for ES or NQ) will try make remarks (in the plan) if there is supply or demand left.

🟧 Orange is “line in sand” for a day, also will try make remarks in the plan (for ES or NQ only) if some demand/supply etc.

🟩 Green(s) are probabilities supports S1,S2 and “Extreme”.The zones and parts of the levels are derived from my own unique math formulas that I have built over the course of my lengthy journey. These are very powerful tools of mine in the 10% reminder that, when used correctly, make things very powerful (that is, every trader's journey to improve their execution throughout their entire life).

The "last / extreme" zone, which is either upside or downside from raw figures, has less than 5% probability of breaking or closing above/below, so that gives me a significant extra edge in my toolbox for intraday PA, which I try to fit with untested supply or demand per different timeframes to create more forceful resistance or support for me to look at and act on if so.

Nothing in this game is 100%, and that is something that everyone should be aware of. I developed additional weekly "max" probabilities for the week that I would mention if we were close by, but the main point is that the last weekly probabilities literally break and close around 1-3 times a year only. That’s another powerful tool (edge) for me to mix with the main concept.

Some asked and saw ATR levels posted for each timeframe on the top of the chart. I already mentioned it many times in the past, and little about it is in the methodology post. They are ATR trailing levels per timeframe that I have specific settings on that have developed and worked best over the years. They NOT support or resistance, they just trail for each timeframe. What this means is that if someone enters trade out there and uses ATR trailing, they are trailing with that level, but that’s all. I have raw stats for them, especially for Globex. Like 1h or 4h tf ATR is very hard to break during an overnight session (I would say around 10% times per year if that), so that’s just a little extra toll/stat/edge in the toolbox. Even though all are displayed, I only use 1h, 4h, D and W for ES. 4h, D and W for rest futures, and D and W only for stocks if so. The ATR level won’t change if TF is not close (same as the main concept). So for example, if I have a 4h ATR in the untested supply or demand zone (even for different time frames), or near … it is just making that zone more significant, so little extra conviction for me as well, that area should react for me to take a risk because every trade comes always with some risk.

My eyes from watching screens for around 50,000 hours in life catch many other repeating patterns or imbalances. I keep an eye on the in-depth chart, which is a nice visual of DOM orders. I got that chartbook last year from a friend of mine, so I do not need to check on DOM with it at all, and I love it. I see and know where OR (opening range) or IB (initial balance) are. Sometimes I look to see where VWAP is because the masses are looking at it, or I am aware of VPOC or POC etc but all that stuff is just "I know, see if so,” because again, my main execution comes 90% to one simple setup that I apply and how I adopted between multi-timeframes. Everything else (with less or more weight to it) makes the 10% that, with a combination of the main concept, makes a more “powerful combo” (if executed correctly).

Overall, as many see by now, I keep things very simple because, in my opinion, simple works best. I am also not making 20 or 50 trades per day. I do plan to make 1–4 trades per day at the most, be patient and disciplined, and be very selective. If I don’t make any for a day or a few, that's a zero problem for me too. I do not want to risk it if I do not have the setup, and patience is extremely important. Also … “Less is more.“

After many years of swing trading, I took break from that and concentrating on day-by-day only/mostly. I try not to be in trade for more than few days max. Usually is same day (intraday) execution with 1-2 days holding if so.

Again, this is my market commentary/TA of how I read chart. This is NOT financial advise, this is NOT “alert service”. This is not “mentoring” of any kind. I DO NOT SELL any courses or mentorships. This is my own “market diary” that I am happy to share how I see, and whoever is interested in checking it out is welcome to do so and can unsubscribe whenever it feels like as well.

I do not care about news (I only look when they are coming for potential volatility), I do not care about macro or fundamentals, just technical the way my eyes see it. Execution is all another ball game though, I am working year after year to improve (the hardest part in this game) that part of my journey.

Thank you for stopping by to check out my newsletter, God bless and wish everyone as much health and success in their lives!

“Rhino”

SOME LONGER EDUCATIONAL or INFO POSTS:

Disclaimer:

Any related materials in the newsletters or posted on Twitter are for educational purposes ONLY. This is NOT financial advice, and the author is NOT a Financial Licenses Professional. Any material shared is not to provide legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, futures, or other financial instruments or investments. Examples that address specific assets, stocks, futures, options, or other financial instrument transactions are for illustrative purposes only and may not represent specific trades or transactions that might have been conducted. This newsletter or anything posted on the Twitter/X site, and any information or training therein, is also not intended as a solicitation for any future relationship, business, or otherwise between the subscribers or participants. No express or implied warranties are being made with respect to these services and products.

All investing and trading in the securities market involves risk. Any decision to place trades in the financial markets, including trading in stock, futures, options, or other financial instruments, is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary.

COPYRIGHT © / INTELLECTUAL PROPERTY:

All charts and ideas published here are Copyright © (Substack “@keepitsimplestupidrhino” / and twitter “@Kiss_rhino”)

All content posted by Author on Substack: “keepitsimplestupidrhino.substack.com” and Twitter “twitter.com/KISS_RHINO” is protected by trademark and copyright laws, except when the author gives permission to share some posts ONLY.

You can not modify, transmit, sell, transfer, upload, etc or create derivative works from them. Making unauthorized reproductions or copies of the content may result in legal action.