PATIENCE - SELF DISCIPLINE - POSITION SIZING, and RISK MANAGEMENT are important aspects of consistency in trading (EXECUTION).

In the pinned post Trading METHODOLOGY based on Legs, Support Loss/Gained, Momentum, and Progression (click here) under the EXECUTION & PSYCHOLOGY section, I already mention little about execution and psychology etc., but I wish to make another post more detailed with a good example(s) from this week about patience, discipline, risk management, etc., and how I see and how to make better execution of the concept I trade on. Imo traders should talk way more about mistakes than post random "good stuff" to show how great they are, because more important is to learn from mistakes and improve during the trading journey to make the least of them.

Happy reading !

First, let’s talk about the KEY aspects of consistency in trading and execution that come with it: Patience & Self-Discipline & Position Sizing & Risk Management.

PATIENCE

Too often, indeed, we enter a trade too early without having done a proper analysis and especially wait for proper setup or exit early with the fear of losing our profit. In short, we undermine our performance. In my opinion, nobody can teach us this other than us working on it ourselves over our lifetime trading journey.

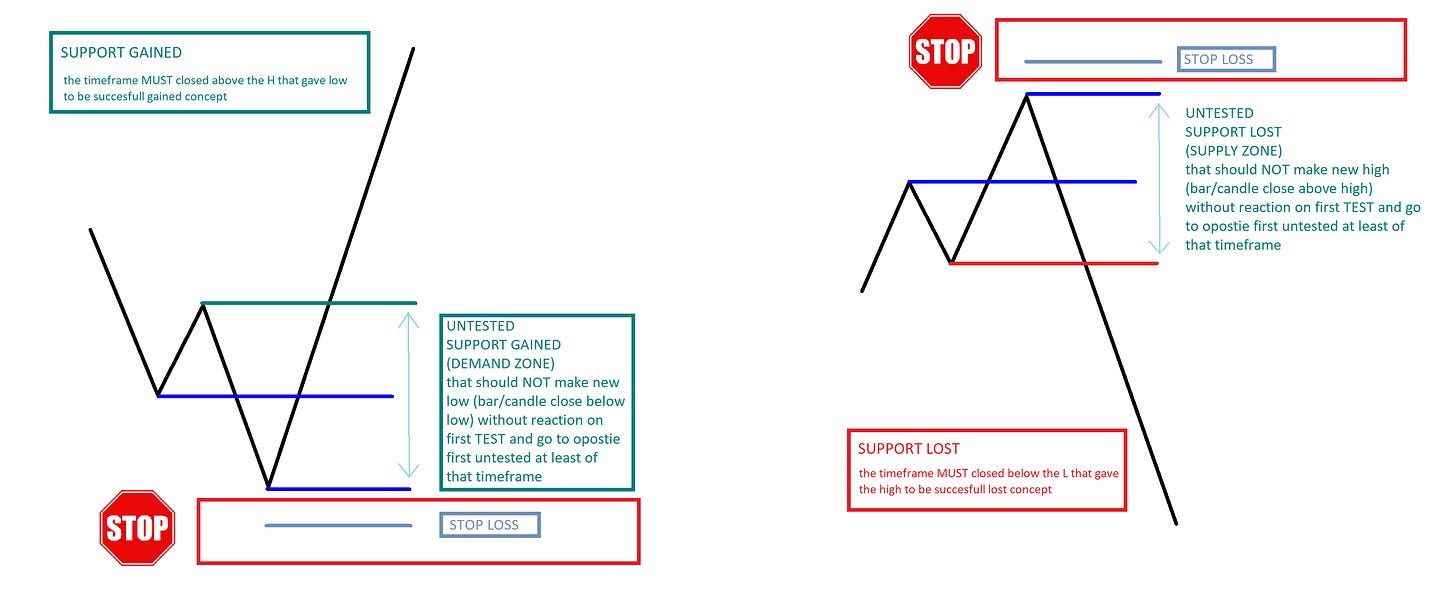

Traders and investors demonstrate the virtue of patience in a number of ways. First, there is the concept known as patience to entry. This is where a trader does analysis on an asset and identifies a possible signal or catalyst. Patience comes in because they need to wait for that signal to happen. The concept I execute on is very simple: wait for proper support loss or support gain within the timeframe I want to execute the trade on. It really is very simple to follow... so wait for a move we clearly understand and wait for your trade to develop.

When I wait for setup to happen and trigger per methodology concept, I rarely ever have a loss. That way I will with that timeframe progression, and that's the safest way, imo, especially when entering on the backtest. Executing that wat, I also don’t have much of a drawdown, and the stops for the trade, if so, are in the 10–20 pt range (if trading on a smaller scalping timeframe like 1600t, they are even much less). The bigger drawdowns or problems come when I “front-run” entry without set-up, even in an untested zone, especially on a higher timeframe because large timeframes like Daily or Weekly often have a wide zone for entry. The main thing I do is set orders in advance, which helps me with "wait time," aka patience. The moment I see an untested zone, especially on M15 or 1h timeframes, where usually zones are much smaller than Daily and Weekly, I set orders without even thinking about it because I believe my analysts that it is untested and will need reaction.

I never enter or set orders for trade that wouldn’t know my exit (usually a conservative exit) or where I should cut for loss if it goes against my plan. Patience to exit is an equally important concept. It simply means that you should be patient before you exit your trade. There are several dimensions to all this.

For example, at times, you will open a trade, and then it moves sideways for a while. During this time, your trade will not be making any money. Therefore, you could be tempted to exit the trade and find opportunities elsewhere. That’s where "set and forget" limit orders come in handy for me, and I keep them conservative to make sure I will have a high ratio of filling my exits instead of missing and turning winning trades into losers.

Another example is when you have opened a trade that has become moderately profitable. Instead of waiting for the profits to add up, you get impatient and exit the trade. While you have made a profit, you have not maximized your profitability. That happens to me a lot, actually, especially because I use conservative exits a lot, but also year after year, trying to improve more.

Last but not least, if you are using a copy-trading approach, waiting to exit can cost you substantially. I do not do that, but many traders do. This is where you decide to end a loss-making trade without knowing the reasons why the "master" trader initiated it. That’s pure garbage. People on social media are following other traders blindly, they are biased; they have no idea what size others are using, what timeframe they are looking at, or what they are targeting most of the time, but they blindly follow. Most of them blow accounts with time.

Nobody should ever enter a trade based on another trader's analysis without doing their own analysis and understanding why.

Causes and Effects of Impatience

When it comes to trading, fear and greed are two powerful human emotions. Traders can have a fear of missing out (FOMO), a fear of losing money, or a fear of not being right. Greed also comes into play when traders want instant gratification, are drawn to "get rich quick" schemes, or expect an unrealistic amount of profit. Another emotion that comes into play is boredom. It can be said that good trading is methodical and disciplined, rather than an activity filled with thrills and excitement.

These emotions combine to make traders impatient and undisciplined. Professional traders and investors know this all too well:

"The stock market is a device for transferring money from the impatient to the patient." Warren Buffett

"After spending many years on Wall Street and after making and losing millions of dollars, I want to tell you this: it was never my thinking that made the big money for me. It was always my seat. Got that? My sitting tight!" Jesse Livermore

Some negative effects of impatient trading include:

Taking too much risk: With an urge to quickly make a large amount of money, a trader enters into a trade with too large of a position size or with too much leverage. Similarly, with FOMO, traders may impatiently enter a trade when the risk-reward ratio is no longer in their favor.

Over-trading: not waiting for good setups before entering trades or entering sub-par trades that don’t match the trading plan’s criteria.

System hopping: not giving a profitable system a chance to make money before switching to another one.

Entering too soon: Fearing the price will get away from them, traders will hurriedly enter a trade at a price where the risk-reward ratio is not in their favor. Or, in fear of losing too much money, a stop-loss will be set too close to the entry price.

Exiting too soon: Fearing the price will turn against them and the profit will evaporate, traders exit before hitting their price target.

There are undoubtedly some general approaches to overcome the fear, greed, and boredom that accompany trading. For me, this is a short list that helps me the most to overcome most of the time:

Set and Forget - Avoid using market orders. Basically, all my orders are limit orders. Wait for set-up, and as soon as I get a proper loss or gain, I’m setting limit orders. I barley used hard stops (that changing in 2024 bc sizing up and concentrating on day trade only). They will also limit orders when the setup fails, but with ticks around the price at that time when failing. I set wider stops tho for overnight to sleep better and protect capital, but they are usually much wider than the setup requires, and I think I can still improve that part on my end over the next few years bc many times hard stops could save me money.

Alerts: Because I hate hard stops and try to avoid them, I set lots of alerts. What can be lost or gained per direction opposite to the trade I am in. I know the level, but I just don’t want them to sweep the level. They will never close the timeframe, so I prefer to have alerts instead. Also, setting a reasonable hard stop, like 10 points for M15 or 1h, could be an improvement for many because if we don’t set that hard stop, we'll start questioning ourselves, "Should I let it play longer?" when it goes against the plan, which definitely happens a lot of times and gives me plenty of room to improve and work on this aspect in the future still.

Keep it Simple: There isn't much else to say here except KISS. Clean charts, cut the noise, and concentrate on what is in front of me on the chart.

Position Sizing: Over time, I’ve learned position sizing plays a very important role in increasing the patience to more faithfully execute a given strategy. Ostensibly, position sizing is more about financial risk control than instilling patience and discipline. Over time, however, I’ve appreciated how keeping position sizes smaller helps me stay more composed and patient as well. Conversely, when a position size is too large, fear can override the discipline and patience needed to methodically execute a trading strategy. I will talk more about it below.

In my experience, there’s no quick fix or single tactic to become a more patient trader. The tactics described above have helped me, but it has taken both lots of time and lots of trial and error to find specific tactics that fit both my personality and trading style. I’m always on the lookout for new ways to improve my trading.

SELF DISCIPLINE

Discipline is also a virtue, and it means doing the things you need to do to progress and get better, even if you don’t want to do it.

As you may have guessed, it takes discipline to be able to remain patient during our daily trading activities. But this is of primary importance to avoid big losses, especially when we also get caught up in our emotions.

On a rational level, we usually know the right approach to trading, but our unconscious cognitive biases are dragging us towards adopting irrational behaviors. This is where the vast majority of traders fail.

Imagine a random pair of traders. One trader has a superior trading strategy and ample capital resources to make it work. But he lacks discipline. The other trader has a mediocre system, fewer capital resources, but superior trading discipline. The non-disciplined trader has everything going for him except for himself, whereas the disciplined trader has a few things working against him, but his ability to remain disciplined serves as his core strength.

Self-discipline is very hard because some type of internal justification will suddenly make it "OK" to act against your trading plan. Most of the time, we aren’t even conscious when the rationalization is taking place. We’re so engrossed in the thoughts, and they seem like good reasons at the time.

Winning traders are disciplined. They control their impulses and feelings, and this allows them to execute a trading strategy effortlessly and flawlessly. The disciplined trader is decisive. The undisciplined trader, in contrast, wavers. He or she may stick with a trading plan occasionally while going a different way at other times. Discipline is indeed a key ingredient to success, but not everyone has a high level of self-discipline. It’s worth determining where you stand on this trait, and if you lack discipline and self-control, work to build it up because there is no success in this craft without it.

Like I said many times, this is a whole-lifelong journey and a whole-life improvement game. Year after year, I grow in patience and discipline, but I know that the "screw ups" will still happen down the road from time to time because, simply put, I’m human.

Discipline and self-control are well-studied personality traits. Some people are highly disciplined and very self-controlled. They scrupulously follow rules and are careful to control their impulses. But when it comes to trading, the most disciplined and patient people didn’t achieve a high level overnight; it took them many years to get to that point.

During my trading journey, I had many "breaks", either when in the past I blew accounts and needed a break, or when there was a family or business issue that I needed a break, or simple financial problems. I had times that took 3-6 months break from trading, BUT I never stopped looking at charts; I always was checking tape / price action mostly of one instrument, whether I was on screen with one eye open, or in the evening playing on-demand replay of recent or random days PA or simply on the phone. I’m not going to lie; for most of the last 20 years, I was and am mostly still addicted to trading, which is my passion. Finding balance in life for traders is very important, Vacations, breaks from screens, peace in nature, you name it so …

... So try this exercise if you lock discipline: spend a few weeks trying to control as much of your life as possible. Pick specific areas where you can gain more self-control. Control your caloric intake, the money you spend, and the time spent in leisure activities. See how well you do. It may change your reference point. You may soon discover that you rarely control your impulses and can do much better. And this, in turn, may positively influence your ability to stick with your trading plan. It’s worth trying. Discipline is the key to trading success, and it’s vital that we do everything we can to increase it.

POSITION SIZING

If I had to choose one tactic that has most positively impacted my trading patience and discipline, smaller positing sizing is definitely it! I’ve dialed back my position sizes to the extent that I don’t really worry about fluctuations in any single position. In general, I can sleep at night and more patiently and methodically execute my trading strategies. Whenever I start "sweating", it means I oversize my position(s). With the recent volatility and levels where indexes are at, most people don’t need large sizes to make a good income anyway. 1% of ES is over 40 pts alone, trading micros these days, especially since early 2022 when high volatility kicked in, should feed most traders more than enough too.

I had people DM me that were building swing positions, and the price moved 20 pts only against them, and they were "max out". I mean, you CAN NOT DO THAT. If someone has an account to trade 1 or 2 contracts, they should downsize to micros and trade 1-3 micros at the most for the first entry. Later, when trade will work, traders can still make money and build brick by brick (same as when they built Rome in the past), but when it won't work out or they will have to average out in next big zone of higher tf will have plenty of bullets left to do so.

It's very simple … if you worry about money in trade you at, you simple put too big a size on it ! The stress that will come with it will only in the long run destroy the account, most likely, I have been there, I have done that, and I do understand why people do that, but the soonest someone figures out to STOP this will improve trading dramatically, imo.

There is no doubt that all traders want to capture big winning trades – those that double, triple, or even quadruple their trading capital. But the fact is trades that deliver 2x, 5x, or even 10x can be very rare. While they do come along, chances are that your trading capital can be wiped out if you put all your money into a single trade thinking that it will be the big one. Instead of risking all or a large majority of your trading capital in a single trade, you’ll be better off utilizing effective position sizing techniques within your trading strategy. Most successful traders – whether they are trading futures, stocks, or options – swear by the importance of position sizing in their success.

Imo, the stop loss if I have to take it should not be as bigger that in worst case scenario I could get back with a smaller size of the same amount of points in 2-4 trades. Because math doesn't lie, I have had a winning rate on ES over 90% recently, but if I size incorrectly, no matter what the win rate would be, I could wipe myself. People can win 70% of the time and be nicely profitable with good position sizing and risk management, but there are traders who can win 90+% and not be profitable for the same reasons.

For me, when I front run zone without proper set up I will never put larger size on first fills, I’m aware that we might still go deeper or higher per direction, and I might have to add to build the position, so by the half way I should not be more than half size total with half bullets left to the end for my full size. Do I do that all the time? Sure, I make mistakes because that's life, but that's how it should be, at least imo. Again, the best way, imo is to wait for the proper set up and not front running, and be patient!

As you can imagine, opening positions with random sizes or based on gut feelings will eventually end in disaster. Position sizing is about preventing excessive losses. If you have a sound risk management plan and follow it, chances are you will not lose a significant portion of your capital on a single trade. It will also give you a chance to keep your focus on your account as a whole and all your open positions. Especially for short-term traders who have to react quickly to new developments, it can be easy to lose oversight and forget how much risk they already have running before they open further positions. This is why it is crucial - a good trader is also a good risk manager.

If people have problems calculating what their average can be at what level and how much they will fill at what point, I would advise using a weighted average calculator to know in advance at what point the average will be and what the drowndown and dollar amount will be, either if trading papers for practice to learn good habits or micros or regular contracts. I used to use the calculator all the time for many years, esp when building swing positions in advance, and I still do so from time to time. Here is the link to the weighted average calculator: → https://www.rapidtables.com/calc/math/weighted-average-calculator.html

For a random example, if someone wants to trade 10 contracts but the zone can be even 100 pts, instead of waiting for the "A+ set up" and front running, here is a decent breakout imo:

This is only an example, but if the trade starts producing in the beginning of the wide, large zone, I can still win, and I don’t care if it is small size, because there will always be millions of new opportunities after (always is about that brick by brick and staying safe). But if it makes all the way to the end, my avg per this example of 100 points lower will be only in 30 points in DD, and because of that, at least the last level should give us some reaction to get out for some profit or b/e, or in the worst case, minimize the loss, and still there are some bullets left "just in case the sweep of the last level scenario." Now, do I follow this "perfect" example always ? of course freaking not haha, but I do try most of the time to size myself correctly.

In conclusion, while as traders we all want to bag that big winning trade, it’s best to use position sizing techniques to ensure we can protect our trading capital. After all, we all want to be able to trade the next day (and that will be impossible if all your capital has been wiped out in a single trade).

And remember that oft-repeated market saying not to put all your eggs in one basket? That is not only about diversification. At the core of that wise saying is risk management – position sizing.

Don’t forget, is all about TWO THINGS in position sizing:

1. Preventing big losses

2. Optimizing profit potential

First and foremost, traders are "risk managers", so before you start trading real money, you should be able to do position size calculations in your sleep!

RISK MANAGMENT

Risk management is one of the most important concepts in day trading. It refers to a situation where you attempt to maximize profits while reducing risks. It is a topic that I have covered above: Patience, Self Discipline and Position Sizing.

Even a discretionary trader can usually improve his trading by applying a more disciplined approach to risk management. Being certain about how much to risk on a single trade and not going beyond this threshold may limit losses by helping you avoid trades that may be tempting but are potentially ruinous.

The average trader spends the majority of his time trying to develop his trading edge, namely looking for "better" indicators, or trying to find other ways to improve his win-rate. Trading failure is usually not caused by inferior trading systems, but by the inability to follow the rules. As I mentioned in the past, I used to blame everything around me when I lost, but not myself. That stopped many years ago, and I am now well aware that loss comes only from me and me only. Just think about all those trades where you entered too early, broke your rules, chased trades, took too much risk, exited too early, were too greedy and gave back profits, or did not close a losing position and ended up with a much greater loss.

Honest self-reflection, meaning assessing your trading performance objectively, will often reveal that it ‘s not our trading methodology that’s the problem, but you: your ability to execute rules that are clearly laid out for you to follow.

Risk management can help prevent a trader from losing all their money on the account and should be applied by both beginners and experienced traders. Successful traders are generally aware of both the potential risk and the potential reward before entering a trade (think about that weighted average calculator as a helpful tool). The goal of a trader is to place trades where the potential reward outweighs the potential risk. These trades would be considered to have a good risk/reward ratio. A risk/reward ratio is simply the amount of money we plan to risk compared to the amount of money we believe we can gain. I usually try not to take trades that have a lower ratio than 1:2 or 1:3 so at least if I am super conservative, I could end up with 1:1. A stop-loss is a pre-planned exit order for a losing trade. These can be executed manually or automatically, As mentioned earlier, I prefer to do limit orders when level is lost or gain against my setup, but I can clearly understand that for many, if not most, a hard stop is a much better/safer thing to do because it will eliminate overthinking when it comes to the point of taking that loss. The purpose is to cut losses before they grow too large. Stopping a losing trade can be one of the hardest things for traders (it sure is to me, even though I don't have that many of them) to do consistently. However, failing to take stops can result unnecessarily in much larger losses or, for some, even margin calls, and ultimately account blowouts.

The concept I execute on is very simple, it comes to the same setup I explained in another (pined) post and is beyond simple, all I have to do is follow the rule and execute. When I don't follow the rule, that is when I FAIL.

Risk management is an important discipline in the corporate sphere. If done properly, it can propel a well-run company beyond what anyone imagined. Risk management is like the foundation of a house. When you build a house, you first start with the foundation layers, and only then you start building the walls, the roof, and everything else. On that note, risk management is the foundation of a successful trading plan.

We can basically break down the risk management foundation into 3 layers:

Risk Planning

Trading Risk Reward ratio

Position Sizing

Yes that position sizing I talked about above is very critical !

Planning your risk will help you maintain consistency with the risk we take when trading the markets. Becoming a consistent trader is one of the biggest hurdles that you need to conquer, and it can only be done right from day one if you plan your risk exposure. Again, is lifelong improvement journey. No trader gets every decision right. So, it’s essential to develop a comprehensive plan for managing risk within your trading, especially when using leverage, which will amplify losses as well as profits.

In the end, all I need to do is follow the simple rules !

As I mentioned in METHODOLOGY post about Mark Douglas, I would strongly advise anyone to read and/or listen to as much of his stuff, legendary person. Just Google him up. No matter how long I do that or how other traders do that, this is a whole life improvement game. I take walks, and if I am not listening to music in my earbuds, I put one of his stuff from youtube and listen again for the 50th or 100th time, probably.

EXAMPLE(S) FROM THE TRADING CONCEPT

The main idea for me to make this post was to talk about a recent swing trade of mine, how I should have had more patience, what I had clearly seen but ignored, what I should have done but didn't, and what I did well. As said earlier, it's easy to post the "wining" stuff, and it looks cool and might attract attention, but IMO it's way more important to talk about bad stuff when it happens, not lying yourself why it happened, and remind yourself to try to avoid it in future. So let's review it …

So at the beginning of the month, I was in my swing short position that was also building in advance, and I closed conservative after a few weeks finally (patience paid but I should also wait for the best proper setup to enter that). After that, I was expecting lots of "chops" for a while, and that’s exactly what we got for the next 1-2 weeks of this month, and I traded a lot day by day both ways when I could, but I started concentrating more on the long side mostly because my belief was that we would hold the daily/weekly support zone (that actually was tested) and that we would have a good rally. That being said, mid through the week or so I start building long swing positions again in advance without waiting for the proper set-up. The progression was clearly down on all timeframes except weekly until we would lost support. I had extra probabilities on my side that this week wouldn't close below 4361 ( and we did not but again, I start building too early without proper patience and against simple rule ).

First here is weekly tf, with the main base demand zone. We did not close below 4368s of the low of that base, but we did close below 4410 that was move that gave us this year H, so because of that we can not make a new H without smacking after testing supplies, and most of the time this produces more lows with time. One thing is sure, we should have bc all that good volatility moving forward for a while.

Now if I zoom to Daily in same zone for more details, we had that 4470 area with 4420s (my favorite) and 4390s/80s if so below, and of course they can sweep the lows (as they did) to take the stops.

The moment we were coming to the 4470 area, around 4480s I exited conservative with my swing short and started day-to-day trading that produced many good trades, but in the middle of the week, when I filled small long again around 4480s/70s I just decided to hold bc my lean that we would hold and produce a good rally reaction (we still can, but we need to start regaining, which won't be as my bias was earlier in the week tho).

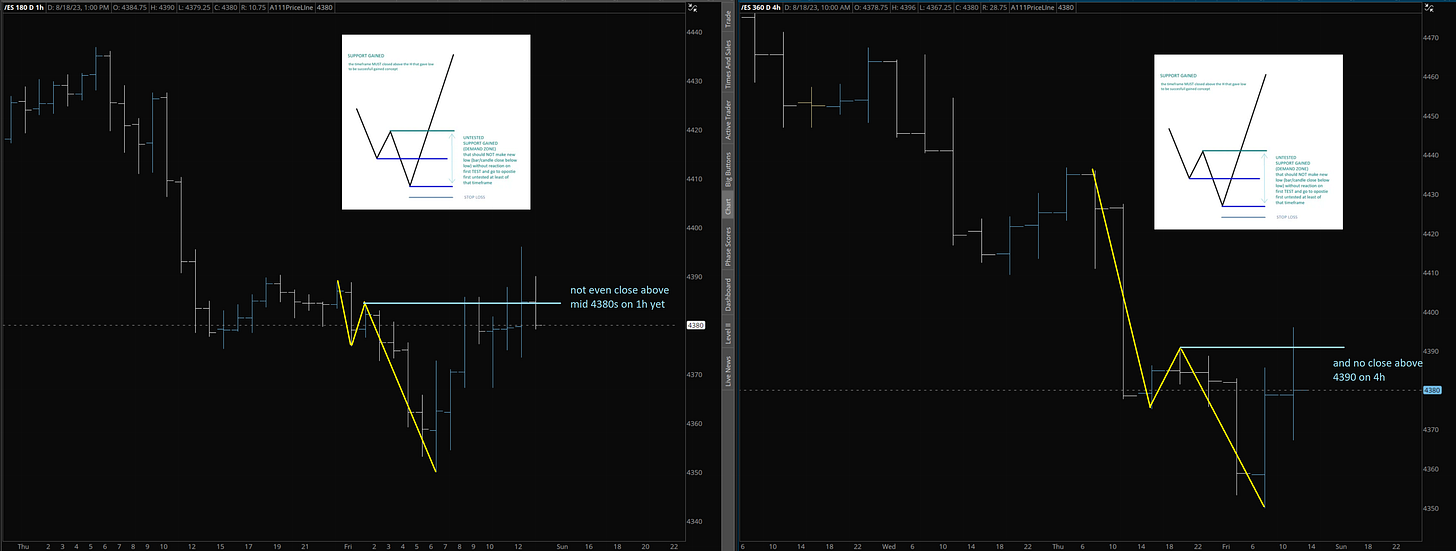

First of all, that whole area was tested because, if I look at the simple concept, the 4410 was a backtest after Daily regain 4427 back in early July, and I was aware of it, but it was the last weekly zone, so I made that decision without patience.So now what should I have done is to have my levels marked and wait for M15 and best for 1h regain to take swing long position.

When we looked at M15 and 1h we had a few , followed by a quick loss of support, so let's move to 1h and review one. (We had two so far on this move down, another was prior with exactly the same structure around 4470s )

So we had that 1h regain there that produced a small pop but on the way prior, they already tested the support that could bypass, so they set up the move to fail in advance, I’ve seen that, but because I believed with strong conviction that weekly/daily would hold again, I ignored and kept holding my swing position, and I added per my plan at 4420s/10s I made also without set up.

So by that time I start too early without proper gain, and later on that 1h I should respect set up to take stop loss and wait for the next entry, but I held on again.

We made it later to the 4380s ( that was a possibility that I knew and mentioned a dozen times), where, without any set up again, I added to lotto SPY calls, a third mistake at least on this whole play.

Because my probabilities that we won't close (they are very strong math probabilities) weekly below 4361 I did one last addons fill at 4360s , also without waiting for regain set up of M15 at least. 4th rule breaker on that play bc I was biased that we will hold that zone between being the last weekly zone, and seasonality bias (stupid , still can play tho) that was posting with probabilities of no closing below 4361 ( that math respected well ).

That last addons worked out and helped me with my avg but again, I did them prior to the M15 regain, not after setup as I should. Sizing correctly helped me at least to cut for smaller loss in the end (with the luck bc that last addons prior to regain).

And why did I cut for the loss ? My probability that we won't close below 4361s this week is only on a week by week basis. So from the new week, the probabilities change in my system, AND MORE IMPORTANT we were in last supply on that M15 and the next two timeframes, 1h and 4h both have to regain 4390 (1h at least mid 4380s but 4h right above, so that’s why 90) for the proper setup so .... that’s why I decided to cut for loss at mid-4380s and wait as I should safer and per risk management. The moment we regain that 4390 I can jump back in with the same size and run at least for 20s-30s pts as the bare minimum. So here is 1h (left) and 4h (right) side by side.

So in summary of my execution on this whole play:

(Bad) I failed to have patience and wait for a proper setup, and I did front run my fills.

(Bad) Failed to stop when setup on 1h happened but made new low later and should wait for the next one.

(Neutral/Good) was mostly ok/good in terms of sizing, despite the fact that it ended up being heavy in the end.

(Good) taking a loss bc Charts told me soo till we would get the regain so I can cut the future potential loss, be safe, and can wait for set up/regain or can play short size when get M15 set up loss like this :

So by taking that last decision of cutting for loss, I am able to wait with patience and be safe to re-enter if we regain that 4h or if we lose M15 4373s. I will be able to trade some short side, at least to the lower 60s/high 50s (that zone is tested, btw) with core and hold partial for new lows if so. But if I kept holding that position, I would have to trade on hope of gaining and would not have the possibility to take a short setup if that will happen because I would be stuck in a losing trade.

HOPES DO NOT PAY BILLS !

I’m sorry for any typing / grammar mistakes. I born in Europe and English wasn’t my first language ;)

LONGER EDUCATIONAL or INFO POSTS:

Disclaimer:

Any related materials in the newsletters or posted on twitter are for educational purposes ONLY. This is NOT financial advise and author is NOT Financial Licenses Professional. Any material shared are not to providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, futures or other financial instruments or investments. Examples that address specific assets, stocks, futures, options or other financial instrument transactions are for illustrative purposes only and may not represent specific trades or transactions that might have been have conducted. This newsletter or anything posted on twitter site and any information or training therein is also not intended as a solicitation for any future relationship, business or otherwise between the subscribers or participants. No express or implied warranties are being made with respect to these services and products.

All investing and trading in the securities market involves risk. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments, is a personal decision that should only be made after thorough research, including a personal risk and financial assessment, and the engagement of professional assistance to the extend you believe necessary.

COPYRIGHT © / INTELLECTUAL PROPERTY:

All charts and ideas published here are Copyright © (Substack “@keepitsimplestupidrhino” / and twitter “@Kiss_rhino”)

All content posted by Author on Substack: “keepitsimplestupidrhino.substack.com” and Twitter “twitter.com/KISS_RHINO” is protected by trademark and copyright laws except when Author give permission to share some posts ONLY.

You can not modify, transmit, sell, transfer, upload etc or create derivative works from. Making unauthorized reproduction, copies of the content may result legal action.

I just discovered your blog. I love it. From which country are you?