Big picture for & about BONDS: (ZN_F, ZB_F, UB_F & ETF's: BND, TLT, BSV, LQD & VOO), SILVER (SI_F & SLV), GOLD (GC_F & GLD), DOLLAR ($DXY & UUP)

I was posting about Bonds futures earlier this year on Twitter, but this will be my first Bonds with Gold/Silver/Dollar newsletter post, so let's make it worth it because there should be some good potential swing opportunities coming with time, and I wish to be part of some, at least with etf’s.

What is Interest Rate Trading?

Interest rates can affect everything from a standard car loan to the entire stock market. Higher interest rates often suggest less economic growth or a contractionary period, whereas lower interest rates can spur economic growth or an expansionary period. However, there’s greater nuance to interest rates which can provide an opportunity for traders to speculate on the future path of rates or manage risk in investments and everyday life.

US Treasury interest rates are some of the most oft-quoted benchmarks in the entire asset class, and they are commonly referred to as the risk-free rate of return in investment modeling. Treasury rates (or yields) are referenced in daily news items concerning markets as well as loan agreements affecting both everyday people and large public companies. They are the underlying market for many popularly traded interest rate products.

What is the Difference Between Interest Rates, Yields, and Bonds?

Interest rates, yields, bonds, and notes are all parts of the same organism, and they all move in tandem. Interest rates and yields both refer to the percentage associated with a given Treasury or alternative interest rate market. Bonds and notes present the price associated with the same markets. The most basic relationship dictates that interest rates (or yields) increase as bond (or note) prices fall, and vice versa.

Let’s break that down further:

Interest rates are the percentages charged to a borrower by a lender on a given loan amount for a given duration of time.

Yields are another term for the percentage paid on a given instrument like bonds or notes or dividend-paying stocks.

Bonds represent the price associated with a loan taken out by a government or corporation that has a loan amount and interest rate built-in.

Notes are another term for the price associated with a debt security, similar to bonds, that tend to indicate a shorter time frame.

At the end of the day, you can view interest rates as being derived from the bond or note price. For a given move lower or higher in price, there is a coinciding move higher or lower in rates. Many find it easiest to stay in the world of rates so as to not confuse ideas of where you think interest rates are headed with corresponding and inverse movements in bond prices.

What is the Difference Between the 10 Year Treasury Yield and the 30 Year Treasury Yield?

The “normal” state of a yield curve is usually defined as having higher interest rates for longer durations. Thus, 10 Year Yields are commonly higher than 2 Year Yields, and 30 Year Yields are usually higher than them both. Interest rate products can also see an increase in volatility, or price movement, with an increase in the time frame, or duration.

The 10 Year US Treasury Yield measures the interest rate on 10 Year US Treasury Notes. Given its central position in the US Yield Curve between short-term rates (2 Year) and long-term rates (30 Year), the 10 Year US Treasury can garner some of the greatest trading volumes. It can be thought of as the S&P 500 of interest rates as it is the quoted benchmark in many news items pertaining to this asset class. You can trade this market with Small 10 Year US Treasury Yield futures.

The 30 Year US Treasury Yield measures the interest rate on 30 Year US Treasury Bonds. Given its greater duration than the 2 Year and 10 Year, the 30 Year US Treasury can be viewed as a longer-term benchmark that moves with greater volatility than other parts of the US Yield Curve. You can trade this market with Small 30 Year US Treasury Yield futures.

The 2 Year US Treasury Yield measures the interest rate on 2 Year US Treasury Notes. Given its lesser duration than the 10 Year and 30 Year, the 2 Year US Treasury can be viewed as a shorter-term benchmark that moves with lesser volatility than other parts of the US Yield Curve and can move with greater correlation to the activity from the Federal Open Market Committee (FOMC). You can trade this market with Small 2 Year US Treasury Yield futures.

Types of Interest Rate Markets

Interest rate markets can be accessed in the form of cash or spot, ETF shares, or futures. Most cash or spot Treasury products are only accessible by large institutions, and they tend to carry a large size. ETFs such as TLT and TBT can be easier for the everyday trader to consume, but the way they look is not directly related to a Treasury yield or price. In comparison, futures can be low-cost, direct avenues to trading interest rates.

Example US Treasury Yield Markets

Small 2YR US Treasury Yield Futures (S2Y) let you access the 2 Year US Treasury Yield in a relatively small, low-cost product that moves in $10 increments per 0.01% (or 1 basis point).

Small 10YR US Treasury Yield Futures (S10Y) let you access the 10 Year US Treasury Yield in a relatively small, low-cost product that moves in $10 increments per 0.01% (or 1 basis point).

Small 30YR US Treasury Yield Futures (S30Y) let you access the 30 Year US Treasury Yield in a relatively small, low-cost product that moves in $10 increments per 0.01% (or 1 basis point).

2-Year T-Note Futures (ZT) are a more traditional product tracking the 2 Year US Treasury Note price in $7.81 increments per 1/8 of 1/32 of one point.

10-Year T-Note Futures (ZN) are a more traditional product tracking the 10 Year US Treasury Note price in $15.53 increments per 1/2 of 1/32 of one point.

U.S. Treasury Bond Futures (ZB) are a more traditional product tracking the 30 Year US Treasury Bond price in $31.25 increments per 1/32 of one point.

TREASURY Futures:

US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. Bond futures are financial derivatives that obligate the contract holder to purchase or sell a bond on a specified date at a predetermined price. A bond futures contract trades on a futures exchange market and is bought or sold through a brokerage firm that offers futures trading. The terms (price and the expiration date) of the contract are decided at the time the future is purchased or sold.

KEY TAKEAWAYS

Bond futures are contracts that entitle the contract holder to purchase a bond on a specified date at a price determined today.

A bond futures contract trades on a futures exchange and is bought and sold through a brokerage firm that offers futures trading.

Bond futures are used by speculators to bet on the price of a bond or by hedgers to protect bond holdings.

Bond futures indirectly are used to trade or hedge interest rate moves.

Let's concentrate on a few now: ZN, ZB and UB since they are the most popular.

ZN_F:

10-Year futures are the most actively traded Treasury product on planet, and it's share of risk transfer grows during non-U.S hours, and during periods of higher volatility.

The 10-Year T-Note futures are futures contracts whose underlying asset is the 10-Year Treasury note. It is a financial derivative product that represents a contract to exchange a specified amount of a qualifying 10-Year T-Note on a future date at a pre-agreed price.

As with T-Bonds, T-Note contracts are standardized, and trading is overseen by a regulatory agency that ensures a level of equality and consistency. A coupon payment is made every month to the t-note holder until the maturity year is reached. The 10-year T-Note contract trades on the CME Globex platform, and at the contract expiry, the seller of the bond futures contract delivers a Treasury bond that satisfies the terms contract in areas of maturity range and interest rate.

You can use the T-Note futures strategy to speculate on the direction of the U.S. government’s medium-term interest rate changes or hedge risk at the short end of a yield curve.

To check more information visit CME Group (here)

This is weekly timeframe ↑ We are in MAJOR multi multi year untested demand.

The safest way is to wait for a Weekly regain or at least a Daily regain so alerts set.

We had some gains on 4h and 1h but if they will carry on to higher tf’s is only anyone can best guess, so just have patience. The Weekly level to gain atm is marked blue, and the Daily level is marked yellow. I will use those colors for other instruments moving forward in the post. Daily atm would need to gain 112 zone and Weekly would need to regain 113.1s.

ZB_F

Simply put, the ZB, also known as the ‘T-bond,’ is a long-term, 30-year U.S. Treasury bond. The U.S. Treasury usually borrows money by issuing bonds and notes for a fixed term, such as 2-, 5-, 10-, and 30-year terms at a fixed interest rate.

Traditionally, these bonds were determined by the prevailing market rates at the time of the issuance of the bond. The ZB offers a different trading perspective compared to other indices. It is usually sensitive to major economic reports, and specific changes typically result in fluctuations in trading.

Bond prices are directly affected when interest rates fluctuate, which can affect the equity, forex, and commodities markets. The relationship between interest rates and bond prices is inverse. When rates or yields rise, bond prices fall.

To check more information visit CME Group (here)

This is a weekly timeframe ↑ We are in the Demand zone, and this zone is tested, so it is weaker at the moment, but this zone is so important that if it doesn't hold, it is "wild wild west" below.

Like ZN, ZB did have some gains on 4h but I am not interested in anything lower than Daily tf at least to think of any swing position via etf’s and/or futures. So at the moment, Daily would have to gain 123s and weekly 127s. Alerts are set above and below.

UB_F

The Ultra Bond Treasury Contract (UB) are for 30 year US Treasury Bonds with expirations of 25 years or greater. This compares to the 30 Year Treasury Bond Futures Contract (ZB) which are for the same 30 Year Treasury Bonds, but with expirations in the 15 to 25 year range. Same product ultimately, different time horizon.

Usually people are still completely confused. Most people can’t wrap their heads around how they are both the 30 Year US Treasury Bond, but somehow different. Remember, you are trading a CONTRACT to purchase the 30 Year Bond, you aren’t trading the actual bond itself. Those basket of goods that contract represents are the same underlying product, but some are older than others.

There’s a reason the Ultra Bond has more movement than the 30 Year (ZB). It’s a contract that represents a product that’s further out in time, and thus there’s more time sensitivity.

Ultra T-Bond futures and options are a natural complement to the U.S. Treasury futures complex, providing market participants with a more direct way to manage long-term interest rate risks and add duration to their portfolios.

The Ultra T-Bond futures contract is the fastest growing interest rate futures product ever introduced by the CME Group exchanges. Adding options to this robust futures market provides even more opportunities for market participants seeking longer-dated, off-balance sheet exposure in Treasury markets.

To check more information visit CME Group (here)

This is a weekly timeframe ↑ We are in the Demand zone but as we see if this won’t hold below is almost “infinity deep water”. So again patience.

Like we see, even though UB lost half of its value since 2020 no need to be a hero to front-run this product. It is a wild instrument anyway. So at the moment, I would need to see Daily to gain 130 and Weekly 136s. Again, like with others, alerts are set.

BOND ETF’s

The best bond ETFs are back in fashion after a rough few years.

A rising interest rate environment in past 12 months has caused no shortage of disruptions to the typical investor's portfolio. And Fitch's recent downgrade to the U.S. credit rating, as well as the Treasury Department's boost to its third-quarter borrowing estimate, certainly sparked some short-term price swings in the bond market.

However, with the Federal Reserve finally might be easing back on its aggressive rate hikes and volatility in the bond market settling down, so especially now that many instruments are in multi-year demand zones on higher timeframes, it is at least a good time to keep an eye on it more.

There is an inverse relationship between bond funds and yields, because older (and lower-yield) bonds become less attractive as interest rates rise – and are discounted as a result. This fact has caused many major funds to slip over the last 12 to 24 months. The good news, however, is that a number of bond ETFs are starting to stabilize and now offer yields that are significantly higher than the stock market after these recent rate hikes.

I will concentrate on few ETF’s only from the most traded instruments (you can check full BOND ETF List here)

BND

Vanguard Total Bond Market ETF

Fund category: Intermediate core bond

Assets under management: $94.5 billion

SEC yield: 4.5%

Expenses: 0.03%, or $3 annually for every $10,000 invested

The Vanguard Total Bond Market ETF ( BND 0.00%↑ ) is the most popular Vanguard ETFs for bond investors, and one of the most popular bond ETFs of any stripe on Wall Street. It offers diversified exposure to the bond market in one simple and broad-based fund, with an enormous portfolio of more than 10,000 "investment grade" bonds.

That means debt securities of high credit quality from corporations or government entities that are at lower risk of default. Right now, about 50% of total assets are in government bonds, with another 25% or so in corporate debt and then the rest in "securitized" bonds that focus on pools of mortgage-related assets.

If you're a long-term, hands-off investor then you could do worse than BND. Buying into this one-stop holding gives exposure to the entirety of the domestic bond market without a lot of risk or complexity.

This is a weekly timeframe ↑ There is no demand here other than that we are testing near all-time lows. Weekly is clearly progressing down, and again, PATIENCE for proper setup.

Daily other hand, is in the demand zone, Daily would have to gain at least 72 to get me excited to try a long position on it, and weekly to 73. Same like with others alerts set.

TLT

iShares 20+ Year Treasury Bond ETF

Fund category: Long government

Assets under management: $41.4 billion

SEC yield: 4.2%

Expenses: 0.15%

The iShares 20+ Year Treasury Bond ETF ( TLT 0.00%↑ ) is much more focused than either of the ETF funds. Still, it is one of the most popular vehicles out there to invest in bonds via one exchange-traded product.

As the name implies, this iShares fund only holds U.S. Treasury bonds with a duration of 20 years or longer. The downside is that this doesn't provide a ton of variety or diversification, but the good news is that U.S. Treasuries are one of the most stable assets in the world and viewed by many institutions as almost as safe as cash.

Just remember that the long "duration" of this fund's assets leaves it exposed to the inverse relationship between bond ETFs and interest rates however. That has caused TLT to slump about 35% in the last two years. If the Federal Reserve continues to raise rates, this fund will likely see stiffer headwinds going forward. So eyes on higher timeframe setups.

This is a weekly timeframe ↑ We are in Weekly Demand zone that was tested and reacted at the end of last year. This is beyond important, as we see on the chart. If this level holds, it would be very bullish for the instrument and could create a W pattern as well.

That being said, at the moment, Daily would need to gain 97s and Weekly 103s. So again, same as with others, alerts are set ;)

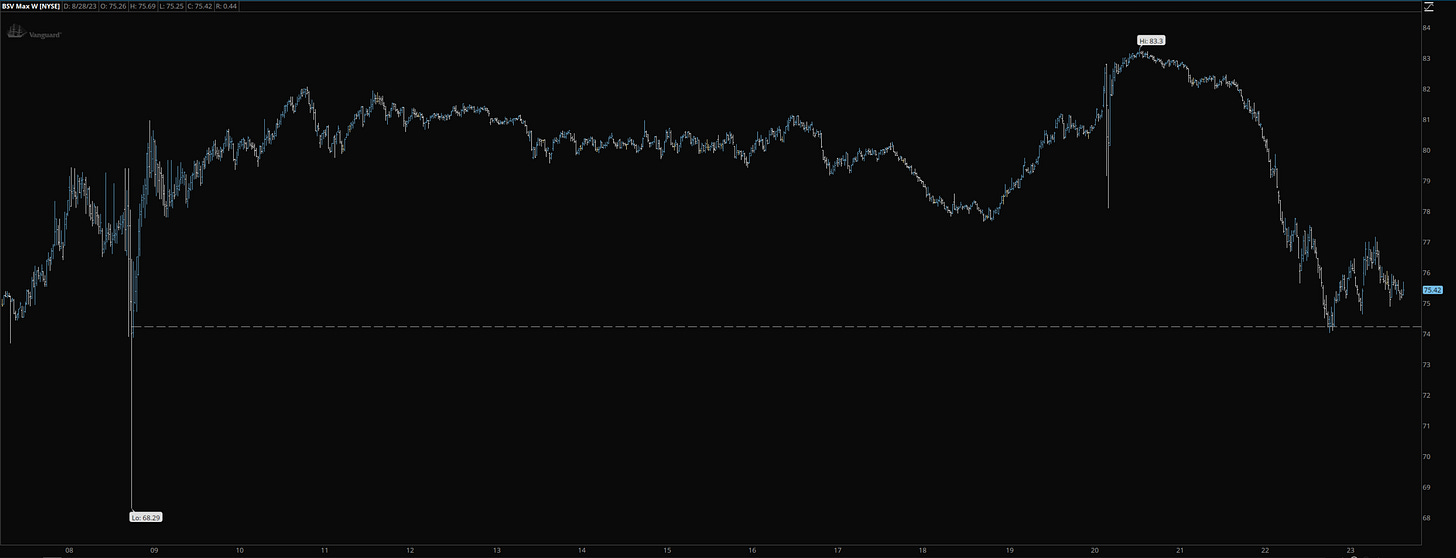

BSV

Vanguard Short-Term Bond ETF

Fund category: Short-term bond

Assets under management: $33.5 billion

SEC yield: 4.9%

Expenses: 0.04%

The flip side of that long-dated bond ETF from iShares is the Vanguard Short-Term Bond ETF ( BSV 0.00%↑ ). This bond ETF has an average effective maturity of less than three years, which is a fraction of the prior fund's average duration.

There's much less risk here on two fronts. For one, it's much easier to predict economic trends a few dozen months down the road vs a few dozen years. Additionally, short-term bonds are less exposed to interest rate volatility.

Interestingly enough, the rising rate environment we've been in for the past year or so has also boosted short-term yields, so you don't sacrifice income potential. This is evidenced in the Vanguard Short-Term Bond ETF's current 4.9% yield, which is more than three times what you get from the S&P 500.

At present, BSV is split about 70%-30% between government bonds and investment-grade corporates, with the top holding being short-term U.S. Treasury bonds.

This is a weekly timeframe ↑ Similar to BND three is no clean demand here other than that we are testing near all-time lows. Weekly is clearly progressing down, and again, PATIENCE for proper setup.

Daily is pretty messy, imo, so the best for this one would be to gain weekly mid-77s or wait for new lows, than regain the move that would give the new low. Overall, I’m least interested in this ETF, mainly play TLT whenever the time comes.

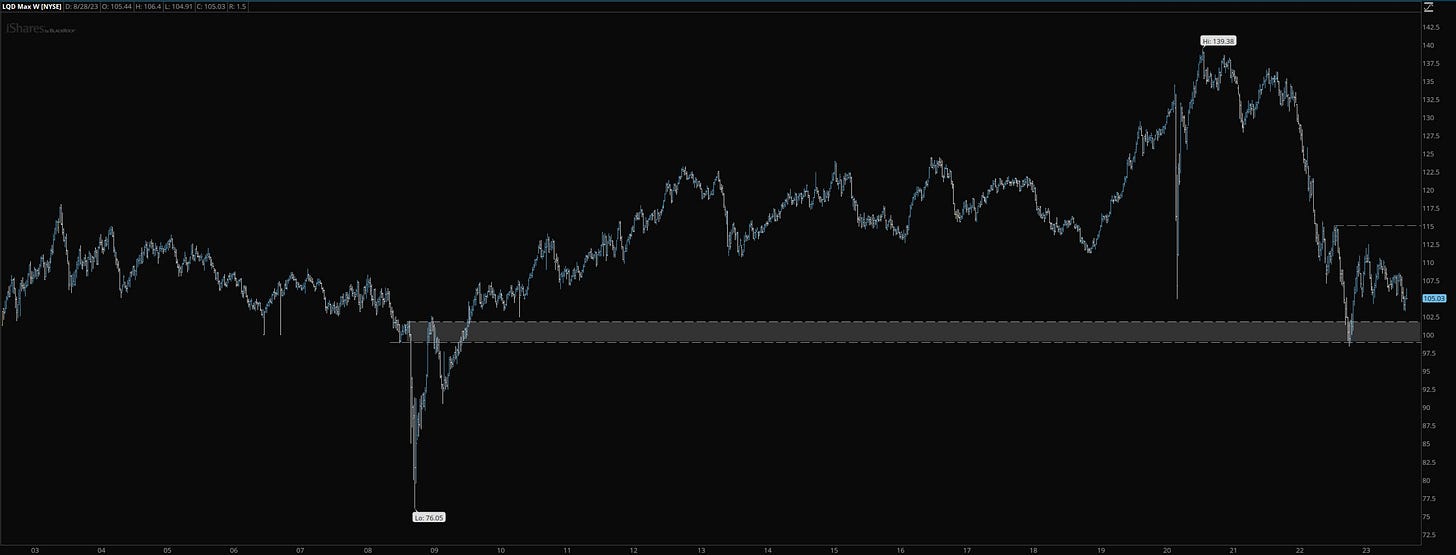

LQD

iShares iBoxx $ Investment Grade Corporate Bond ETF

Fund category: Corporate bond

Assets under management: $35.1 billion

SEC yield: 5.4%

Expenses: 0.14%

The iShares iBoxx $ Investment Grade Corporate Bond ETF ( LQD 0.00%↑ ) takes a different approach than many of the other fixed-income funds featured here by carving out government bonds altogether. This allows investors seeking out the best bond ETFs to turn up the yield without taking on an inordinate amount of risk.

Specifically, LQD owns debt instruments solely from companies with strong credit ratings that are BBB or above. Think familiar names like Big Pharma Pfizer PFE 0.00%↑, financial giant and Dow Jones stock Goldman Sachs Group GS 0.00%↑ and drugstore operator CVS Health CVS 0.00%↑ to name a few.

These are “world-class” organizations that aren't at high risk of imminent failure or short-term disruptions by the latest headlines or fads. This means they are very likely to make good on their debts. But it's undeniably true that, when placed next to the U.S. Treasury, their operations are still riskier than the federal government. That risk premium results in a more generous yield that could be attractive to investors who aren't afraid of carving out government debt from their bond holdings.

This is a weekly timeframe ↑. We hit the perfect demand zone at the end of last year in October and have held above since. Based on this weekly tf I set the alert at 102s at the moment.

As said above, the weekly hold demand zone last year beautiful, and literally, for setup, we would have to gain 115s BUT Daily had a nice regain that time too. At the moment imo we are backtesting that demand on Daily that starts at 102s same as weekly, from the move to ath time lows. I will be looking on the instrument when alerts trigger.

VOO - Vanguard Group

Talking about Bond ETF’s is hard not to mention VOO 0.00%↑. The Vanguard Group is the second-largest asset manager in the world, with more than $7 trillion in assets as of this year. What's more, it's still growing thanks to a powerful brand and some of the most popular and cost-effective index funds on the planet. A long-term, hands-off approach: There are many ETFs out there that claim to provide outperformance by overlaying complex screening methods onto the stock market, and changing out holdings based on the latest info. VOO fund is about as hands-off as you'll get because it doesn't try to beat the index … it is the index, with a fully diversified line of large, domestic stocks. After all, many use the S&P 500 as a shorthand for the broader stock market as a whole. But if you believe in the long-term potential of stocks, there's no better way to gain exposure than to buy the preeminent index. Don't forget to DRIP: The acronym DRIP stands for "dividend reinvestment program." It involves taking the regular profit-sharing you get from your investments and reinvesting that cash, rather than letting it sit idle in your account. The best Vanguard ETFs offer a no-fee, no-commission reinvestment program that allows you to reinvest your distributions and supercharge your returns over time. If you have a Vanguard account, you're eligible to take advantage of its dividend reinvestment program free of charge. This takes the stress out of investing because you don't have to think about reinvesting, and your returns automatically compound over time. It doesn't cost you anything with a fund like VOO if you're working with Vanguard.

I won’t be talking about dividends in this post, I will save that for a special post down the road in the future. Whenever (might be years from now) we get major corrections and restest COVID lows, etc it will be a generational opportunity to load the boat with safe and good-paying dividend stocks and etf’s dividends for a long-term ride.

If we compare quickly our dear ES_F and VOO charts, we can see how they follow each other. We have the exact same setup on VOO between Weekly and Daily tsf’s as was already explained a few times for ES.

SILVER

Many will say that the silver market is white-hot-mess bc “chopping for 3 year ;). Well, that’s partly because demand for silver is more closely tied to economic activity. Unlike gold, which is used mainly in jewelry, silver has many industrial applications. Silver is used in electrical switches and fuses, in batteries, and in the making of photovoltaic cells. Demand for all these uses rises and falls with the pace of the economy. Another reason for the greater volatility is that the market for silver is much smaller than the market for the yellow metal. As a result, a small pickup in investor interest can make a bigger impact on silver’s price than on gold’s.

SI_F

This is a weekly timeframe ↑. Silver had so many beautiful setups last 3 years that it is embarrassing to say that I didn’t play any haha. The lowest weekly wants to go is 21 zone and hold above 20, I set alerts if so for the future.

When I went to Daily there were even more setups (God forgive me pls not playing any). Ideal to hold above 24 for longs, because if that failed, it would probably go down with time to the 21s. I set lots of alerts as I was writing this post because I didn’t look closely or play silver for a long time … just collecting coins ;)

SLV

iShares Silver Trust

Assets under management: $10.9 billion

Expenses: 0.50%, or $50 annually for every $10,000 invested

SLV 0.00%↑ is the largest fund of its kind and arguably one of the best silver ETFs to publicly trade the precious metal. The fund, which launched in 2006, currently holds more than 480 million ounces of physical silver in its vaults, located in England and the U.S. Thus, SLV shares are a physically backed representation of the price of silver.

This is a weekly timeframe ↑ and I will only post weekly because SLV looks exactly the same, of course, as Silver Futures SI_F. alerts set, and there is not much to talk about it anymore.

GOLD

Gold, by comparison, represents a claim on a lump of metal that produces…nothing. As pretty as it might be, gold gets dug out of the ground, refined and then turned into stuff that mostly just sits there. In the first quarter of 2023, about half of all global demand for gold came from the jewelry industry. Roughly a third went into producing coins and bars, while a fifth was purchased by central banks. Apart from demand from these sources, gold has no intrinsic value. The price of gold depends on what you can get someone else to pay for it. This fundamental inertia – gold's inability to generate value and its utter dependence on demand – makes it untouchable for someone like Warren Buffett. Here's one of the billionaire investor's many putdowns of gold:

"Gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end."

Myself, I love collecting coins (silver and gold), not just because I started when Gold was in the 700s ;) but in case of some "Armageddon" (hopefully I would never need to use it to buy "cans of corn" to feed family, haha). Other than this, I will pass it on to my kids and trade it from time to time as any other instrument.

GC_F

This is a weekly timeframe ↑. Weekly tf atm has a good chance for the pullback with time into the mid 1800s and potentially even into the mid 1700s, that would definitely help and bring Silver into that 21 zone. It had a second attempt to make a new ATH, failed to do so, suffered a loss on a weekly than did the backtest in recent weeks, and will see with time what it will produce. Bears want to hold below 1980s atm.

Here is Daily ↑ that might look cleaner. I set alerts and might actually look to short small early next week. I’m not a big fan of trading Gold (may be bc I collect coins), but when I do, I usually play with smaller size.

GLD

SPDR Gold Shares

Assets under management: $59.3 billion

Expenses: 0.40%, or $40 annually for every $10,000 invested

The SPDR Gold Shares GLD 0.00%↑ is the prototypical gold fund: It represents fractional interest in physical gold bullion stored in vaults. That allows investors to participate in the upside of gold prices without having to deal with the hassles of physically storing, protecting and insuring bullion or coins.

The SPDR Gold Shares debuted in November 2004, making it the oldest U.S.-traded gold ETF, albeit by just two months. But being first to market – especially in a major category like physical gold – has, historically speaking, been a massive advantage for fund providers.

To wit, GLD is also the largest U.S.-traded gold ETF by a country mile. The second-largest gold ETF doesn't even boast half of GLD's $59 billion in assets – and yes, it's the very same fund that debuted two months after SPDR's gold ETF.

GLD has one glaring downside: a relatively high expense ratio. Several competitors successfully exploited that for some time, though SPDR finally addressed it.

However, the sheer size and popularity breeds of one of Wall Street's best gold ETFs has several benefits for traders: The fund is extremely liquid and has tight bid-ask spreads, and its options market is more robust than any other traditional gold fund.

This is a weekly timeframe ↑. It has same structure as Gold futures, even that gaps is even more cleaner than GC_F.

And here is the Daily ↑. Very simple, bears to see lower demand(S) into the lower 170s at least wants GLD to stay below 184s at the moment.

DOLLAR

I won't be writing much about it other than charts because this topic about the dollar is very "fragile" these days. Many have different opinions. Between high U.S. debt, Cryptocurrency fans (cults) that think it's better than any government-backed money since crypto can’t be manipulated by governments or central banks (imo they are wrong and that sector will be heavily regulated with time) through world military events, and China yuan (and BRICS) that Beijing wants China to be insulated from any future financial sanctions like the ones Washington slapped on Russia. It has already built its own international payments system as an alternative to SWIFT, the dominant system from which Russia has been cut off. It’s also succeeding in getting the yuan used in more cross-border transactions. Russia in particular has embraced China’s currency to help it keep selling its energy and other exports. China wants to supplant the dollar in its bid to be the new world superpower. While the yuan is sure to gain wider usage, it’s unlikely to replace the dollar. China won’t liberalize its finances to give the yuan the dollar’s advantages: its ease of use, convertibility, freedom to float in value as the economy warrants, etc. The biggest challenge is from within the U.S. due to the risk of country debt.

This is a weekly timeframe ↑. Big thing happened last two weeks for Dollar, it gained/flipped weekly timeframe by gaining 103s. That being said, imo it will go with time to 108s and we will see what happens up there. If I see a 102/101s backtest prior to that, I will buy some UUP 0.00%↑ ETF with stop below year lows

And here is the Daily ↑ . Daily is also progressing up nicely with closer resistance around 105s so may be from there they will give some backtest.

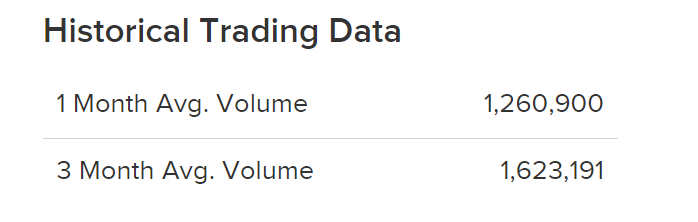

UUP

This ETF offers exposure to a basket of currencies relative to the U.S. dollar, decreasing in value when the trade-weighted basket strengthens and increasing when the dollar appreciates. This fund could be appropriate for investors seeking to a fund that is inversely correlated to the broad stock market or for those making a bet on a flight to quality. For investors seeking exposure to the dollar against a broad range of developed market currencies, UUP 0.00%↑ is one of the best choices out there.

This is a weekly timeframe ↑ UUP weekly timeframe had gain actually tad earlier than $DXY alone, much earlier in Q1 of this year and was backtesting and holding base since.

And here is the Daily ↑.

This is the most known dollar ETF, and as we see due to dollar moves, even though it is the most known dollar ETF, it has only 1.26 million daily volume. That is not much, and we can clearly see it on the Daily chart. Atm, if not in it, definitely looks and feels like it is chasing, so if so, I will wait for the backtest mentioned above, if not too bad, it is no big deal.

SUMMARY:

The main goal for this post was to talk about Bonds, bc I think there will be a very major play on them. There are zero reasons to guess when, because it might be weeks or months ahead, but the point was to do homework and be prepared, and thats what I did. I hope some readers will find this helpful, because it took me a few hours to share with you all ;)

God bless and good luck in any instrument trading... remember PATIENCE because it is the most rewarding in this craft.

"I’m sorry for any typing / grammar mistakes. I was born in Europe, and English wasn’t my first language."

LONGER EDUCATIONAL or INFO POSTS:

Trading METHODOLOGY base on Legs, Support Loss/Gained, Momentum and Progression.

This is a free post about the trading methods and concepts I execute on and how I read charts. It is for educational purposes ONLY ! I put some time into it, so at least if anyone finds this helpful in any way, please share/retweet the original link/post with others on Twitter, etc., and maybe they will find it helpful as well.

PATIENCE - SELF DISCIPLINE - POSITION SIZING, and RISK MANAGEMENT are important aspects of consistency in trading (EXECUTION).

In the pinned post Trading METHODOLOGY based on Legs, Support Loss/Gained, Momentum, and Progression (click here) under the EXECUTION & PSYCHOLOGY section, I already mention little about execution and psychology etc., but I wish to make another post more detailed with a good example(s) from this week about patience, discipline, risk management, etc., an…

Disclaimer:

Any related materials in the newsletters or posted on twitter are for educational purposes ONLY. This is NOT financial advise and author is NOT Financial Licenses Professional. Any material shared are not to providing legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, futures or other financial instruments or investments. Examples that address specific assets, stocks, futures, options or other financial instrument transactions are for illustrative purposes only and may not represent specific trades or transactions that might have been have conducted. This newsletter or anything posted on twitter site and any information or training therein is also not intended as a solicitation for any future relationship, business or otherwise between the subscribers or participants. No express or implied warranties are being made with respect to these services and products.

All investing and trading in the securities market involves risk. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments, is a personal decision that should only be made after thorough research, including a personal risk and financial assessment, and the engagement of professional assistance to the extend you believe necessary.

COPYRIGHT © / INTELLECTUAL PROPERTY:

All charts and ideas published here are Copyright © (Substack “@keepitsimplestupidrhino” / and twitter “@Kiss_rhino”)

All content posted by Author on Substack: “keepitsimplestupidrhino.substack.com” and Twitter “twitter.com/KISS_RHINO” is protected by trademark and copyright laws except when Author give permission to share some posts ONLY.

You can not modify, transmit, sell, transfer, upload etc or create derivative works from. Making unauthorized reproduction, copies of the content may result legal action.

You are a great trader and a good man, but you're also becoming a fantastic blogger. Amazing post Rhino! Thank you as always. Great read man.

Great Article to understand how the system works.