2023 Review / 2024 Goals !

Long Post.

First and foremost, I would like to express my gratitude to all of the subscribers to this newsletter who have taken the time to read my thoughts on the market since the first publication and, hopefully, find something useful for their journey among the good and the bad.

I never imagined that so many people would be interested in "my diary," and I have even slowed the "newsletter growth" since October by keeping it "private" until the end of the year. So again, THANK YOU!

Reminder:

I would also like to remind everyone that this is the last post of 2023 and as of January 1st, as I have been posting on Twitter multiple times in the last few months and making posts here as well, I am sticking to the small monthly subscription fee because, as many of you have already expressed, this whole newsletter/blogging journey requires a significant amount of my time. Further details for whoever missed them can be found in one of the pinned posts, which can be found here:

2023 REVIEW:

I will start with the positive and work my way down to the negative. Anyone who has followed me throughout the year knows that I focus a lot on the negative because I want to get better and get rid of it every year.

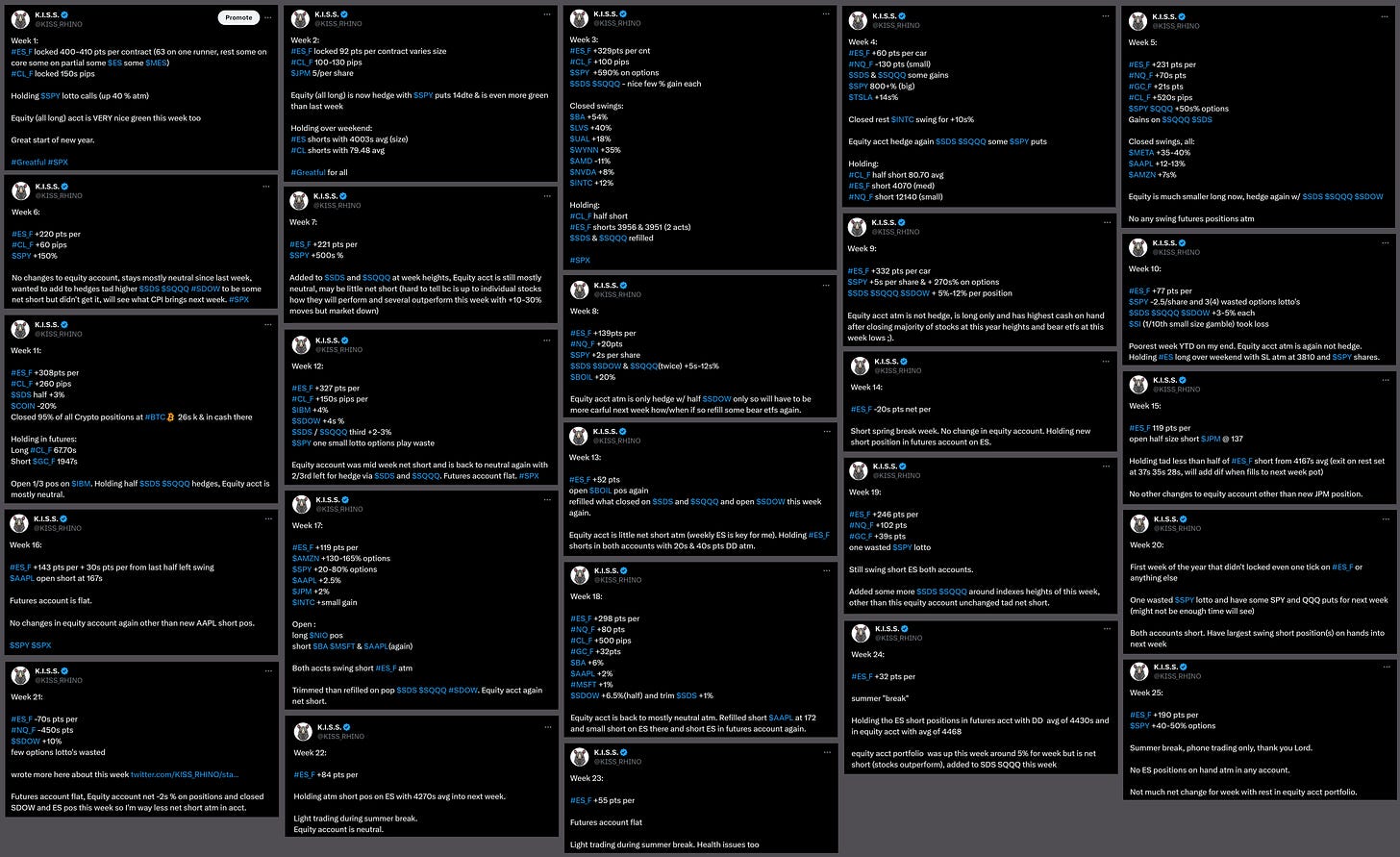

Having kicked off the year with a bang—Q1 was the best quarter ever—those who have followed me throughout the year will know that I posted screenshots of every trade before it happened and a summary of each week on Twitter up until summer break (screenshots of that can be found below). After summer, I stopped doing that because it was taking too much time, but I started a newsletter, which means that everyone can easily access the entire archive.

Therefore, in the first three months on ES/MES alone, I locked in over +2700s points per contract and made a ton on stocks, etfs, and even options lotteries. The volatility I love was present, which made trading much easier than just dealing with one direction trend. In the next three months, or Q2, I added over +1200 points per contract on ES/MES alone again, and by the time summer break arrived, I was around +4000 points per contract with only a few poor executions. After summer break, things became a little rocky; Q3 was okay with some errors, but the worst of 2023 was Q4, with a few large losses on swings, one from a historic move that I could not have predicted but rest only from execution mistakes that all come to Patience, which I will talk more about below in “trading goals for 2024”.

Over the last few years, I have traded a wide range of instruments, including futures, stocks, ETFs, swing and day trading, and cryptocurrency. I concluded my two-year cryptocurrency journey at the end of March, and I am glad to be done with it. I have no real plans to go back to cryptocurrency because I detest it so much; if it hits $1 million or $1, I will not care; I will check it every now and then because I like charting, but that is about it.

Not only did I sell all of the stocks and exchange-traded funds (ETFs) that I had been holding as swing positions for many years, but I also made the significant decision to be 100% cash going forward and to day trade every day through 2024 and possibly longer, at least until I would see a significant market correction. I did this at the end of September in Q3.

Throughout 2023, I made a lot of incredible calls, some of which I followed through on and others were only for informative or charting purposes, and I’m happy and proud of that.

Either I was calling low for a year on TSLA early in January or recent BA (Boeing) and with dozens of other stocks since and between then, which I am not going to screenshot as a waste of time.

or nailing a reversal on bonds by predicting lows on TLT, ZN_F, or ZB_F that was a significant turning point for bonds in October, or calling every significant reversal on the dollar $DXY, including the most recent ones.

I had even prepared a long piece on expected reversals in metals, bonds, and the currency, along with details about the products, back in early September.

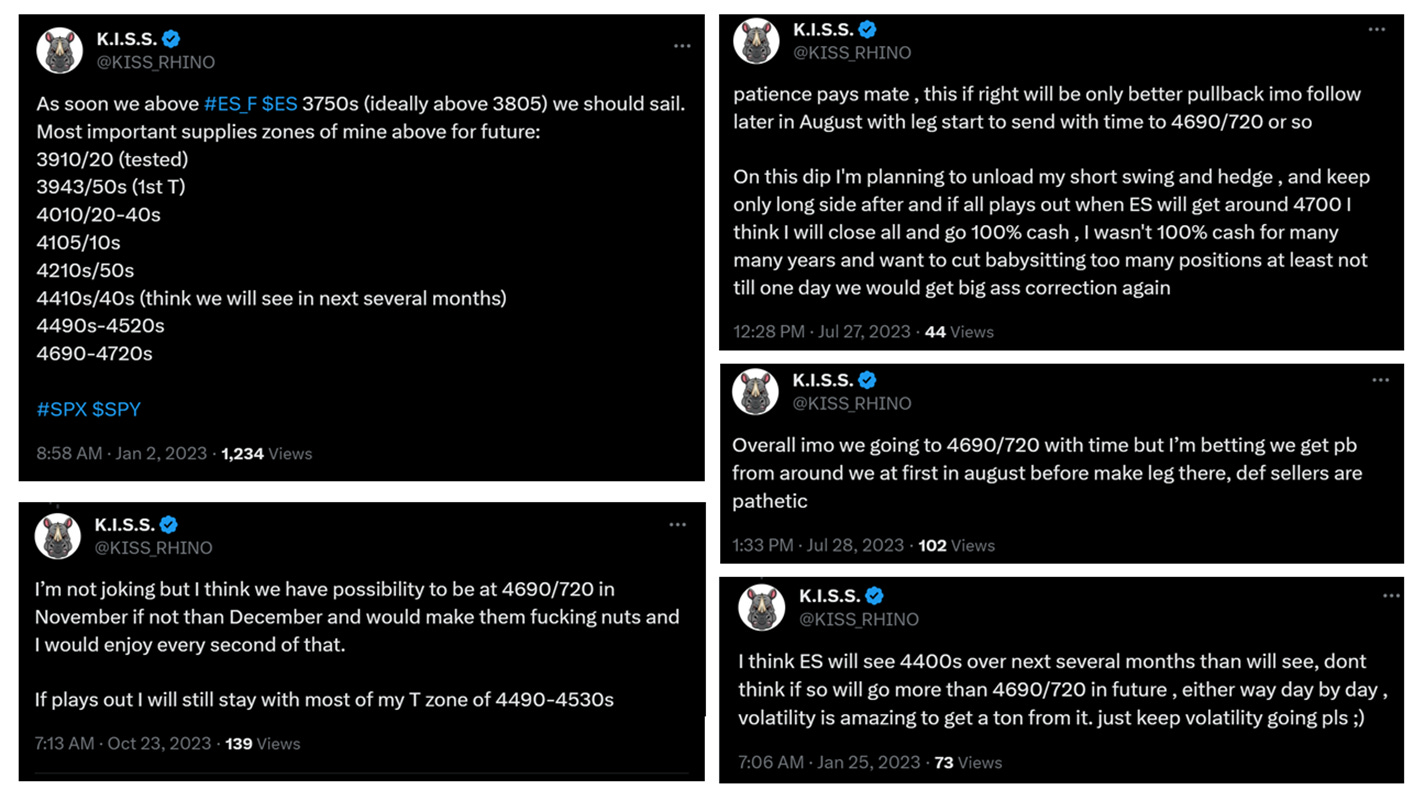

Since the October lows of 2022, I have been positive on markets in the long run. I have also stated several times that the ES may approach 4690/4720s, including at the end of last year and early this year.

I did not anticipate a new ATH, assuming they would store it for 2024 election headlines, but they made a historic move (first time since 1982 structure-wise, that has been referenced multiple times since): Of course, even though I was playing day by day, long and short transactions were practically equal.

So, whether I followed through on them or not, I made a lot of really good judgments. One of my terrible calls was that Gold may drop to the 1500s, which I still believe will happen, but it clearly took a different route in 2023.

The fact that I opened up to the public and posted nearly all of my trades—both good and bad—for the entire year on Twitter and the newsletter is another positive thing about 2023, in my opinion. Most people are aware of how difficult it is to discuss trades we make before they happen, but my biggest problem with traders on social media has always been that very few people post trades before they happen, only yapping about specific trades after the fact to either feed their own egos or promote BS.

Sharing everything with the public helped me become even more organized with charts, especially when I started the newsletter, so there are benefits for me as well, even if it is time-consuming.

I consider charting to be my best trading skill. To get to this point, it took me around 50,000 hours on screens during my journey. I can read chart structures with ease, and I can identify the proper trend or progression for any product's period in a matter of minutes—for an instrument like the ES, it just takes seconds—because I am aware of what each timeframe is doing.

I also strive to improve the accuracy of my daily probability for ES, and I see them as an even more important tool in 2024.

I resumed paying attention to Open Range more after going cash at the end of Q3 (the first 30 seconds should be highlighted, but as the TOS platform lacks a 30-second window, I have a custom script to highlight the first minute).

A friend of mine shared a depth chart with me earlier this year, and I screenshotted it a lot because I find it very visually appealing and it eliminates the need to look at the DOM. I appreciate him sharing it with me and hope he makes another one for NQ soon.

Although the structures remain the same, most traders are aware of how 0 DTE alters market behavior. Because of this, a few weeks ago, I decided to monitor additional services that I had not previously disclosed for the next three to six months in order to see if I could uncover any intriguing intraday patterns that I could add to my toolbox as an extra tool to the main concept.

The service comes with a custom GEX script for my TOS charting platform that will check once or twice per day; I do not care about the other features, like scanners, dark pools, etc. I took it mainly to see SPX 0-DTE put/call volume, interest, expirations, and GEX clear visually that is updated live through the browser. I am not planning to trade SPX options, even though the % moves can be ridiculous (at least not anytime soon). I am just using it for observation only for now to see if it can get me any good by eye to catch or not over time.

In order to avoid confusing people, the primary idea behind my trade is the one I outlined in my pinned methodology post.

With the exception of 10% of additional tools that I use to create stronger combinations based on my own statistics or custom probabilities, 90% of my trading is based on the core idea, and I am constantly trying to become better at charting, even if I consider it to be my strongest suit.

The bad thing I want to talk about and concentrate on next in this post is EXECUTION.

Traders cannot succeed without strong execution, even with the best charting. I have often stated that trading is a path toward whole-life growth, with execution being the key to success.

My biggest losses this year have been the result of overconfidence and a lack of patience. I believe that every trader should be aware of their strengths and weaknesses. I also do not lie or cover up my mistakes or areas where I need to improve in order to continue becoming a better trader. Earlier this year, I wrote a lengthy post about patience, self-discipline, position sizing, and risk management.

I know that accepting a loss and sometimes exercising more patience are the hardest things for me to do, and when I fail at either, it usually results in a larger loss. As most traders begin a new year with the intention of forgetting their mistakes from the previous year, it usually does not work out well for most of them. Instead, each trader should carefully analyze the entire year and focus primarily on the mistakes they have made, making every effort to eliminate as much of it as they can.

Apart from that one historic incident, all other stop losses might be significantly reduced or eliminated by adhering to SIMPLE guidelines of the most SIMPLE trading approach I could possibly come across. I have expressed my disappointment over Q4 hundreds of times, and it cost me dearly as well.

For many years, I traded by building positions in the zone(s), which is why I was always in the swings. As a result, I am looking forward to trading in a slightly different manner throughout 2024 and setting a record for trading profits ...

MY TRADING GOALS FOR 2024:

… that style is to do more trading day by day without major swings but with size.

So…

In order to achieve my best year ever, I know I need to master execution to an even higher level than I master charting. I also know I need to be extremely patient, wait for that setup, not chase, and execute with simple rules. I want to focus on three instruments (and no more than five instruments to have on hand, with three being a good max number already). So most of my concentration will be on my main instrument, ES with the NQ and CL to it, occasionally RTY and some other very occasional extra instruments if so.

Many traders struggle with bias and fomo, but I am mostly unaffected by that these days. I see news and do not care as much about macro/fundamentals, just charts, so process discipline is crucial.

I used to trade without stops for many years, keeping my stops wide only for overnight because I used to swing a lot, but in 2024, I plan to trade mostly RTH/cash hours, with a size on “SETUPS” and strict hard stops with OCO orders.

I need to eliminate unnecessary losses in order to maximize my profits. It is better to miss some moves because there will always be next, rather than regret "unnecessary stop loss." As soon as I see my setup, I will wait for the best fill or set orders in advance many times, and as soon as I get the fill, set the OCO order on the core for conservative T, trailing the rest with a hard stop on all. After my T misses, I must move the stop to b/e, and I need to move the stop to b/e once the core is gone as well.

It is quite basic, but we battle our own brains all the time, so my whole focus will be on enhancing my trade execution in 2024.

Wait for setup!

Be disciplined

Minimize risk (hard stops for the entire year).

The reason I went cash and eliminated long-term swings was to give myself a mental reset after so many years having and dealing with them. When we day trade but have a long-term portfolio, often we do one thing but think about the market to do what favors swings and can affect execution for intraday. Therefore, I eliminated even that before 2024, which I believe will be the biggest shitshow year in politics ever and there is zero need for me to overthink “what might happen / where market might go and when” etc. ONLY CHARTS AND SETUPS!... be like a a robot with no feelings.

I know that I can achieve the best trading and finest year ever if I hone my patience and discipline to a military degree and follow a few simple fundamental guidelines, which I sometimes stray from for whatever absurd reason.

Even if I do not intend to trade them, I will chart other instruments throughout the year and offer a lot of other ideas since I enjoy studying and charting price movement, especially equities around earnings season.

I have already begun going over and updating about ten instruments in my weekly videos, and I will keep doing so, but other from gauging the direction of the dollar, bonds, and metals, I really only plan to focus on trading the few futures instruments that were previously stated.

Swings may sound great, and I may trade them again after some significant corrections or if I see a significant setup on weekly TF before that correction starts to short something. However, my math skills are strong, and I am well aware I can make killing through day trading and going to sleep without thinking about some of my swing positions or ideas.

I come across a number of traders that deal in large lots; they trade for a maximum of three hours a day or, at worst, the whole RTH, but at the end of the day, they have no positions because, in the end, LESS IS MORE. For those who struggle with arithmetic, the following short calculation will help:

There are 252 trading days in year; lets say trader can execute 220 to leave some for some breaks (that’s not even 2/3rd of full calendar year)

1 ES contract for only 10 pts per day multiplied by 220 days is $110,000 per year.

That’s only one contract with only 10 pts avg per day that do not have to happen every day to chase it but for 50 pts per week on avg.

Why am I showing this? To show how the sky in this business is the only limit.

Think of 10,20,25,30 or more contracts for the same math, and you get 7 figures per year. (I met some traders trading 100s lots regularly but I am simply not there yet even that doing that almost 20 years and have no idea if ever will be but thank God there is no need to trade 100 lots to be beyond successful.)

To improve my performance and maximize my yearly profits, I just need to be more disciplined and patient. Take the setup (which I is almost every day at least once, sometimes few times) and knock it on a good-sized core, even for 5-8 points, then trail rest. Of course, when setup is there for the larger 50-100 point moves, charts will show the hands for it, but I still take the core out conservatively per chart read.

So again, this might be a broken record and boring by now, but my main trading goal is to execute to perfection the simple concept throughout the whole year … and in mid-time, if I build one of the best educational newsletter out there, that would be a plus ;)

⚠The bad execution and habits will not magically disappear after NYE. You MUST make a plan to not let it happen again in the future! There are no shortcuts in this craft! Whoever made it to the end of this post and read it, DO NOT FORGET to review your 2023 and concentrate on mistakes, not just accomplishments or trying to sweep “the bad under rug”! Develop a plan to improve areas where you failed the most! Be honest with yourself about what bad habits hold you back from achieving better results and work on eliminating them!

Again, I wish you & your family all the best in 2024 & as much success as possible!

Disclaimer:

Any related materials in the newsletters or posted on Twitter are for educational purposes ONLY. This is NOT financial advice, NOT “alert” service, and the author is NOT Financial Licenses Professional. Any material shared is not to provide legal, accounting, or financial advisory services, and this is not a solicitation or recommendation to buy or sell any stocks, options, futures, or other financial instruments or investments. Examples that address specific assets, stocks, futures, options, or other financial instrument transactions are for illustrative purposes only and may not represent specific trades or transactions that might have been conducted. This newsletter or anything posted on the Twitter site, and any information or training therein, is also not intended as a solicitation for any future relationship, business, or otherwise between the subscribers or participants. No express or implied warranties are being made with respect to these services and products.

All investing and trading in the securities market involves risk. Any decision to place trades in the financial markets, including trading in stock, options, futures, or other financial instruments, is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe is necessary.

Copyright © / Intellectual Property:

All charts and ideas published here are Copyright © (Substack “@keepitsimplestupidrhino” and Twitter “@Kiss_Rhino”)

All content posted by the author on Substack (“keepitsimplestupidrhino.substack.com”) and Twitter ("twitter.com/KISS_RHINO") is protected by trademark and copyright laws, except when the author gives permission to share some posts ONLY.

You cannot modify, transmit, sell, transfer, upload, etc., or create derivative works from them. Making unauthorized reproductions or copies of the content may result in legal action.

Happy New Year !! Thank you for all your sharing.

Excellent summary mate - you’re on my wavelength about “x points per week”, you’re a crucial part of my process to achieve that in 2024

Wishing the happiest of new years for you and the family