#ES_F (#SPX) and #NQ_F Charts, Probabilities & Plan for July 9 plus #RTY #CL #GC #SI

I day traded +13 pts on Russell today, added to my shitty short bag of NQ, keep holding my ES shorts as well and still in short Oil play. Tomorrow, Powell and Yellen yapping.

Quick Summary:

The only thing I day traded was short on Russell, other than this added to NQ short, keep holding shorts on ES (plan on exits is below) and still in my Oil play.

So overall, today between both accounts locked :

Locked +13 pts on Russell

Added to my bad trade on NQ and holding with DD same like ES, also still in my short Oil play.

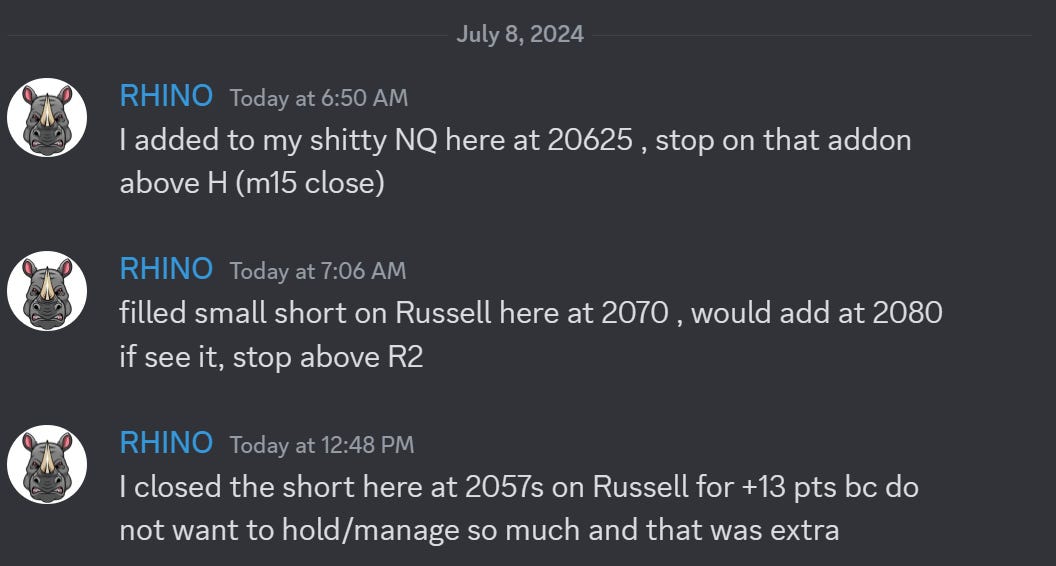

Here is a screenshot from Discord:

I made an earlier weekly post with videos (uploaded in Discord chat) and a copy of the post is here for anyone who missed it but is interested:

For more information on how to participate in the Discord chat (paid newsletter subscribers only without NO extra cost) for any updates during the day check the post if did not yet:

I would suggest that any new subscribers view the primary methodology post with over 40 pages in it, which is available for free to anyone!

Those who would like to continue receiving updates can find additional information here:

Below, I have updated progressions for various timeframes with the current ATR levels per timeframe (on top of the probability charts given below), as well as specific probability levels and zones, and plans for ES and NQ for tomorrow. Also, there are probability charts for RTY, CL and GC.

Keep reading with a 7-day free trial

Subscribe to RHINO's Substack NewsLetter to keep reading this post and get 7 days of free access to the full post archives.