#ES_F (#SPX) and #NQ_F Charts, Probabilities & Plan for Thursday May 2, plus #RTY #CL #GC

Fantastic start to the new month again, up to 50s pts per con locked on ES and a partial in profit left of 60 pts. Tomorrow we have a tad more data, AAPL earnings and Friday is NFP.

Quick Summary:

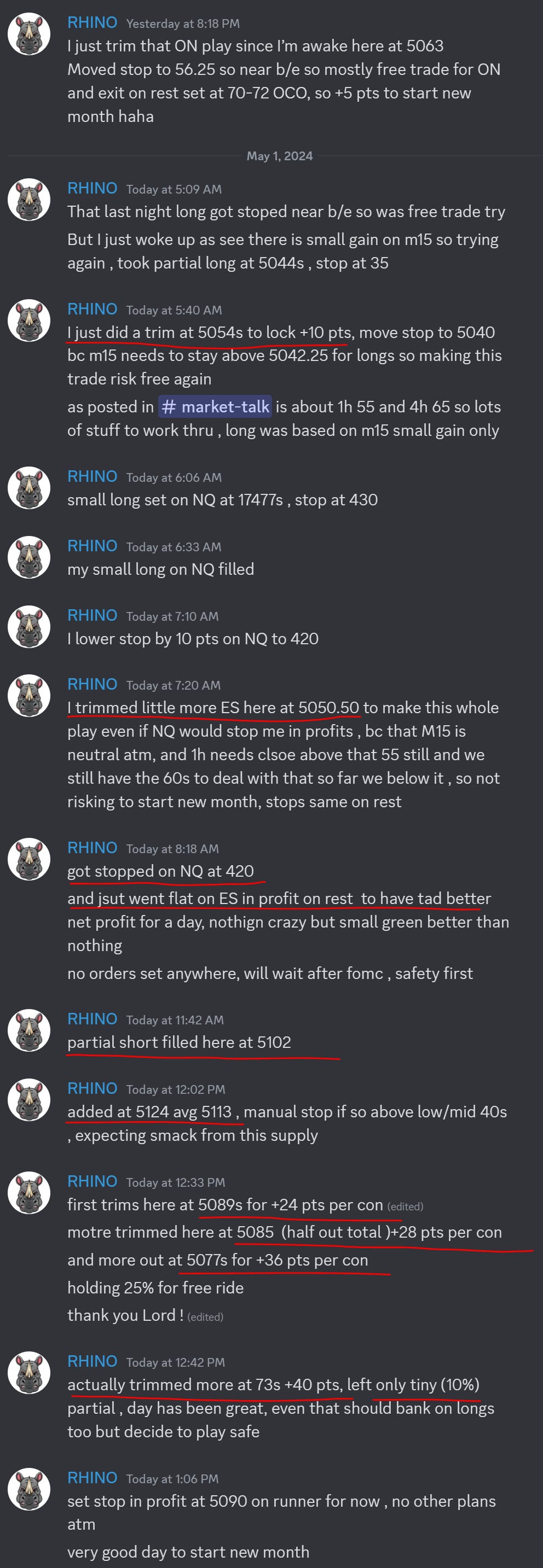

Great start to new month ! All I could do better is hold long that filled in am with original stop but bailed out to be “safe” even that lean was for pop, so missed 30-s50s pts on long side but got short side. I got stopped once on small NQ and rest ES trades were great.

Yesterday, my lean was for a pop because we had a demand at 4h that we hit the end of the day, and after sideways chops, we did pop. Then, my lean was to smack bc we left UNTESTED 4h supply yesterday (textbook), and we did smack:

Overall locked:

over up to +50s pts per con on ES

and took -57 pts on small NQ trade

details about what I did are below on the screenshot, like every day (more explanations with charts etc are in chat)

Here is a screenshot from Discord:

For more information on how to participate in the Discord chat (paid newsletter subscribers only without NO extra cost) for any updates during the day check the post if did not yet:

I would suggest that any new subscribers view the primary methodology post with over 40 pages in it, which is available for free to anyone!

Those who would like to continue receiving updates can find additional information here:

Below, I have updated progressions for various timeframes with the current ATR levels per timeframe (on top of the probability charts given below), as well as specific probability levels and zones, and plans for ES and NQ for tomorrow. Also, there are probability charts for RTY, CL and GC.

Keep reading with a 7-day free trial

Subscribe to RHINO's Substack NewsLetter to keep reading this post and get 7 days of free access to the full post archives.