#ES_F (#SPX) and #NQ_F Charts, Probabilities, and Plan for Wednesday, January 10th.

Before the CPI, will there be one more push toward higher supply? As of right now with yesterday's significant move, we spent the majority of the day within the range. Probabilities for tomorrow in NL

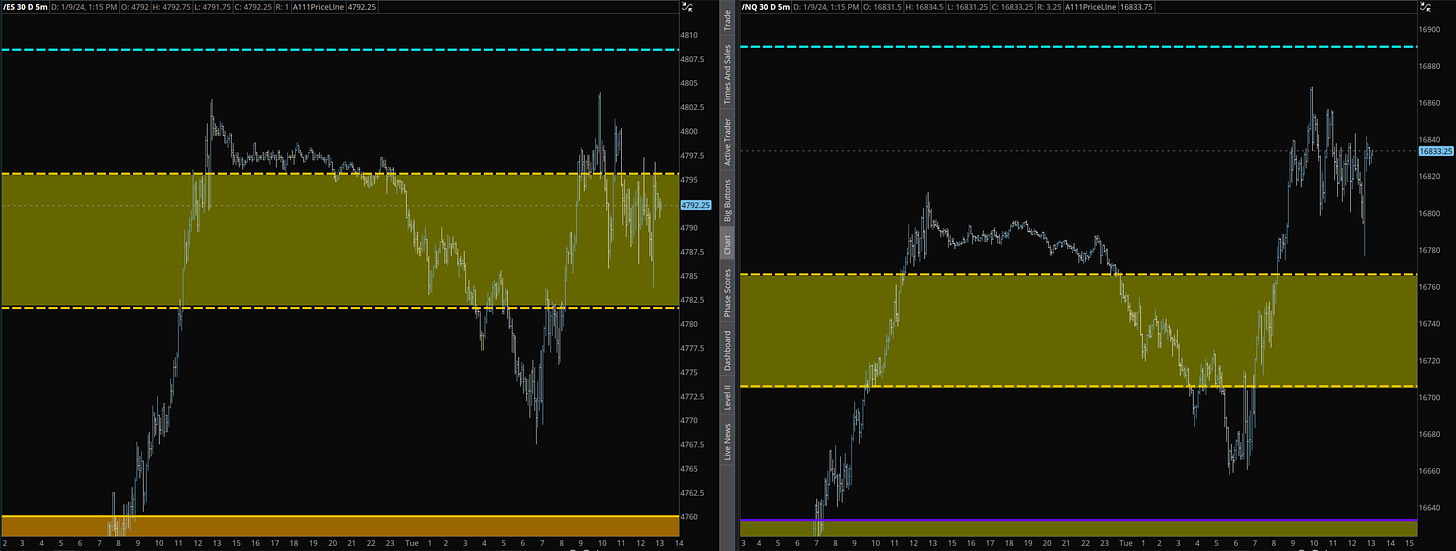

First, here is a chart of ES (Left) & NQ (Right) of how they look today from yesterday's post:

After the monster move yesterday, we spent the majority of the day dancing around the upper "chop zone" that was posted yesterday.

There was a beautiful loss setup, but it happened again when I was sleeping, so I missed the M15 loss setup because of that. In summary, I did not do too much today but locked in some profits:

I did two small trades on NQ that net me only +29/30 pts per contract

On ES, I was waiting to long in the morning but kept waiting for the setup on M15 (maybe I should just take the 1600s/5m setup, but history now). Took short later at 4800.75 that closed conservative for +11 pts per contract.

At the end of the day in power hour, one of a few of my orders at lower 4780s finally filled at 4784.25 and closed that at 4791 for +7 points, and that was all for a day.

All the trades “why and how” are posted in chat before fact or live in the worst case.

I would suggest that any new subscribers view the primary methodology post with over 40 pages in it, which is available for free to anyone!

Those who would like to continue receiving updates can find additional information here:

To participate in the newsletter “Chat” conversation (from Jan 1st to paid subscribers only) for any updates during the day or to check the recent or past daily updates in the chat, click here:

Below, I have updated progressions for various timeframes with the current ATR levels per timeframe (on top of the probability charts given below), as well as specific probability levels and zones for ES and NQ for tomorrow.

Here is the new ES_F chart for tomorrow:

Keep reading with a 7-day free trial

Subscribe to RHINO's Substack NewsLetter to keep reading this post and get 7 days of free access to the full post archives.