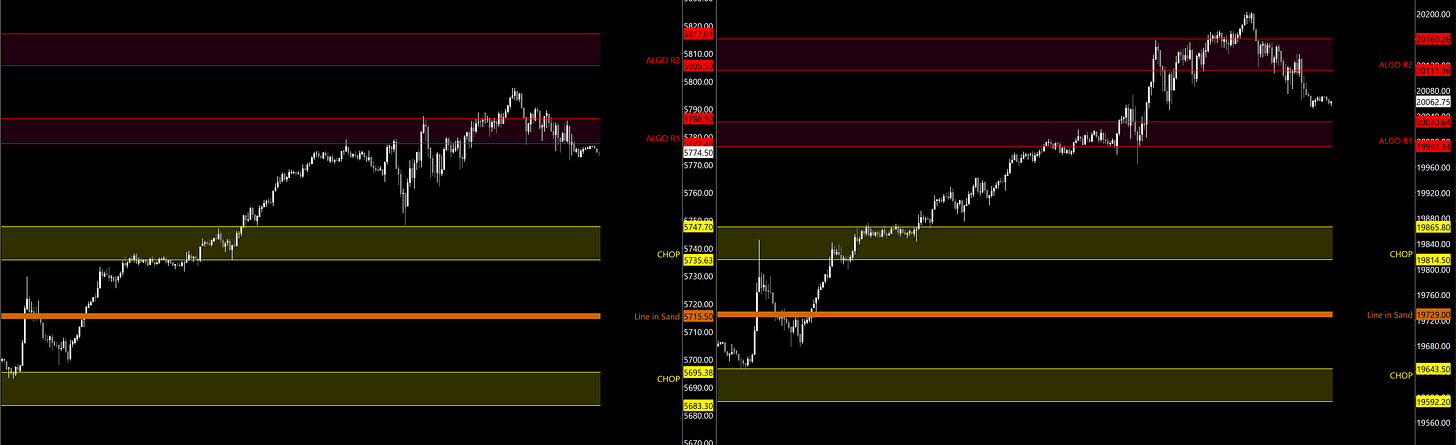

#ES_F (#SPX) and #NQ_F Charts, Probabilities & Plan for September 20 plus #RTY #CL #GC #SI

Left small short yesterday that was 70s pts in profit for "safe/conservative" target of 20s pts more that never happened and took 30s pts loss today. Ugh this market. OPEX tomorrow.

Quick Summary:

I had perfect short fill yesterday during FOMC pop and was looking for 5580s/60s dip and go long, I even set exit at 5597s to be “safe and conservative.” on U24 and they held for like 8th 5610s and never seen inch lower. So I left that going to sleep and woke up at 5700s on U24, took later in the day loss for 30s pts instead. Overall, I made some profit earlier this week and wasted it today, and it is nothing burger week atm but sucks about that yesterday trade, I had such a conviction we would hit the T zone, but we did not. Other than this took pure small SPY lotto puts for Monday exp, if see dip of any kind tomorrow will close, and holding for scalp small long on futures.

I finally rolled today to the new Z24 contract !

Above is a view of my ES and NQ algo charts for today and how they play out (new charts for tomorrow, plus other instruments as well are below).

All intraday details and commentary are in the chat room.

For more information on how to participate in the Discord chat (paid newsletter subscribers only without NO extra cost) for any updates during the day check the post if did not yet:

I would suggest that any new subscribers view the primary methodology post with over 40 pages in it, which is available for free to anyone!

Those who would like to continue receiving updates can find additional information here:

Below, I have updated progressions for various timeframes with the current ATR levels per timeframe (on top of the probability charts given below), as well as specific probability levels and zones, and plans for ES and NQ for tomorrow. Also, there are probability charts for RTY, CL and GC.

Keep reading with a 7-day free trial

Subscribe to RHINO's Substack NewsLetter to keep reading this post and get 7 days of free access to the full post archives.